QuickBooks Self Employed is one of the best accounting software platforms for freelancers and self-employed individuals. Furthermore, this software is good for micro-businesses and solopreneurs as well. However, if the business is in its growth phase, one should go for alternative software. The automatic features of the app help a lot in dealing with mundane accounting jobs.

In this article, you will first get a general overview of QuickBooks Self Employed, which will consist of a small review. Then, in addition to the prices of the application, you will also learn the major features that this software offers you. Next up, you will find out whether this application is a good option for your business or not. Finally, we have also discussed some of the major pros and cons of the software.

QuickBooks Self Employed – A General Overview Of The Software

According to Forbes.com,

“QuickBooks Self-Employed is an online accounting tool specifically for freelancers, solopreneurs, independent contractors and sole proprietors. In addition to tracking your expenses and invoices, the software automatically tracks your mileage, allows you to easily pay quarterly taxes, generates financial reports and can assign expenses to Schedule C categories.”

One of the best things about this software system is that it comes with different subscription options for the self-employed individual. With all the subscription options, you will get top-grade invoicing capabilities in the software system. Not only will you be able to manage your personal and business accounting tasks, but you can also estimate and pay your taxes at the right place.

The software platform is designed by considering a certain type of audience. Hence, this software is not suited for all types of businesses. This application is only good for – freelancers, solopreneurs, self-employed, and micro businesses (consisting of less than ten employees). This means you can invoice only a limited number of customers.

QuickBooks Self Employed Desktop Pricing

As per the information provided by Forbes.com,

“There are three plans available that cost between $15 and $35 per month. The cheapest one offers simple accounting software, and the more robust plan offers unlimited live accounting support. Currently, QuickBooks offers 50% off the first three months of a subscription plan.”

Here are the pricing plans of QuickBooks Self Employed:

| Plans | Pricing |

| QuickBooks Self-Employed Free | Free trial for thirty days |

| Self-Employed | $7.50 per month |

| Self-Employed Tax Bundle | $12 per month |

| Self-Employed Live Tax Bundle | $17 per month |

These plans come with different sets of features. To check them out, you can click on this article.

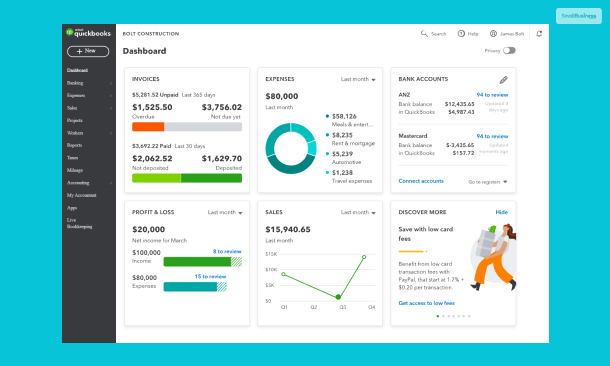

The Major Features Of QuickBooks Self Employed

According to another statement in the review by Forbes.com,

“QuickBooks Self-Employed is best suited for freelancers, solopreneurs and consultants who want an easy-to-use online accounting tool to keep track of their business’s finances.” The following are some of the major features of QuickBooks Self-Employed that you must be aware of:

- The software gives you mileage tracking capability. The feature is also available as automatic and uses your phone’s GPS.

- The automated feature directly imports expenses from your bank account.

- There is a feature to match and categorize expenses based on the photos of the receipts.

- There are many built-in reports which you can use to find out how your business is doing.

- There are various other reports that show you the estimates of the taxes. You will also get reminders of what you owe every quarter.

- With just a few clicks, you can instantly transfer your data to file taxes.

Why QuickBooks Self Employed Can Be A Good Option For You?

According to ChamberOfCommerce.org,

“In many cases, people who use QuickBooks Self-Employed don’t need to spend a lot on an accounting program. But they do need something that is simple, cost-effective, and easier to manage than manually entering data into spreadsheets.”

If you are looking to automate your bookkeeping processes, then this platform can be of great help. Another great thing about QuickBooks Self-Employed is that it lets you integrate with more than 650 business apps required for payment-related transactions. This further helps streamline your business’s accounting processes.

Major Pros And Cons Of QuickBooks Self Employed

The following are some of the major pros and cons of QuickBooks Self-Employed that you must be aware of before you use it for yourself:

Pros

Here are some of the top pros of QuickBooks Self-Employed, from which you will benefit:

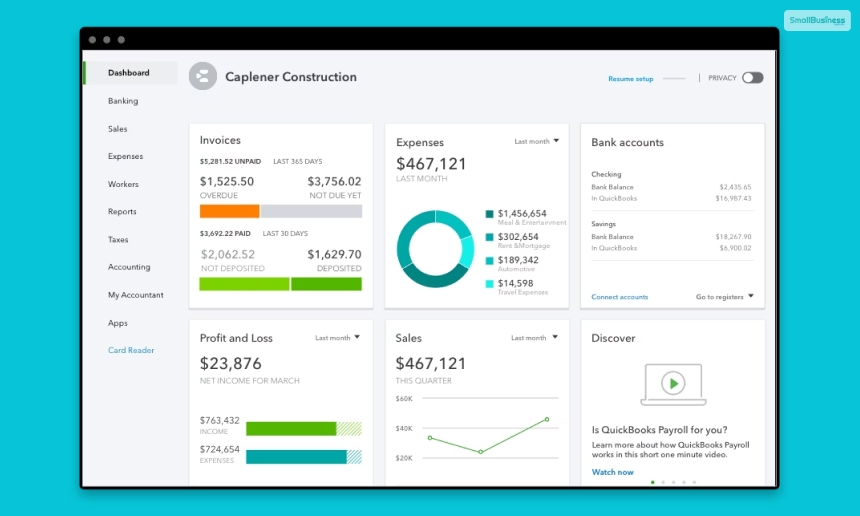

- Just like the Online application platform, this platform is also easy to use and has a simple interface, which will be easy to work on.

- The software comes with an automatic mileage tracking feature, which can be helpful for getting better data access.

- The software is affordable and turns out to be a great option for freelancers.

- Various useful features for the freelancer and the self-employed.

- There are many personalization options for bookkeeping.

- You will get really amazing QuickBooks support.

- Easy creation, sending, and tracking of invoices and online payments that you made to clients on the go.

- Automated connection to your bank account, which leads to automatic records of your transactions.

- You can record your mileage and snapshot your real receipts to save them on your records.

Cons

Here are a few cons of QuickBooks Self-Employed that you must know of prior to using it:

- Not a great option for a small business that is in its growth phase.

- QuickBooks’s Self-employed payroll option is not available.

- You cannot transfer the data to a system where the primary feature is double-entry accounting.

- Expensive as compared to other competitors like Wave Accounting.

- Some users complained about the invoicing designs regarding limited customization options.

Final Thoughts

Although a bit expensive for a self-employed person or a freelancer, the QuickBooks Self Employed platform surely offers some great features. However, there are some other accounting platforms that offer similar features at fewer prices. Hence, the choice is up to you about which software you will go with. Do you think QuickBooks Self-Employed can help you to grow your business? Share your reviews about the platform in the comments section below.

Continue Reading:

Leave A Comment