The government, at all levels, collected taxes from businesses and employees. The W2 and W4 forms are two of the most common forms that are important for filing tax returns. However, sometimes, due to a lack of information and clarity, many people fail to understand the difference between the two. Hence, they ask, “What is the difference between W2 Vs W4?”

In this article, you will learn some of the basic details of the W2 form and the W4 form. Furthermore, as per the primary requirement of the article, we will show you the difference between the two forms, as well as their importance and significance. Later on, we will also give you an idea of the content inside the forms and how to read them.

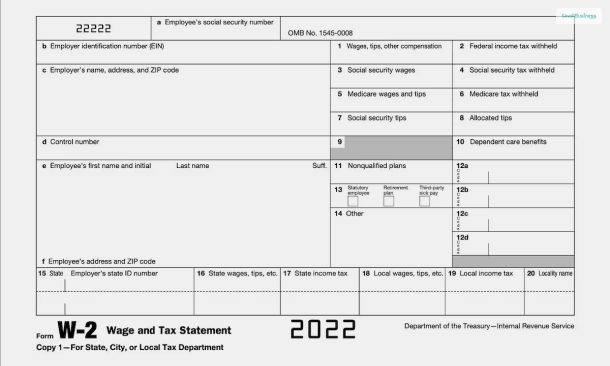

Form W2: What Is It?

According to the Forbes Advisor,

“Form W-2 is a document that reports your annual wages and the amount of taxes withheld from your paycheck and sent to the IRS. It also shows other information such as how much your employer paid for your health insurance and any money you received in dependent care benefits.”

The W2 form is an important document that is provided by the IRS that employers and employees need to fill out. This form contains the details of a W2-eligible employee – including the wage throughout the last year, as well as the amount for taxes that the company withholds from the income of the employee. This form is also known as the Wage and Tax statement.

What Is The Use Of Form W4?

The Form W4 is also called the Employee’s Withholding Certificate. The United States Internal Revenue Service (IRS) recommends employees –

“Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.”

The W4 form is an important document that allows an employee to fill up his/her details and provide information related to the amount the employer can withhold from the employee’s paycheck. The form tells the employer to deduct the amount based on a person’s gender, marital status, dependents, allowances, and many more factors.

An article on Investopedia informs employees –

“The employee fills out seven lines on the W-4 form. The first few lines include the taxpayer’s name, address, and Social Security number. A worksheet included with the form lets taxpayers estimate the number of allowances on their tax withholding.”

Here, if you increase the number of allowances from the side of the company, this will gradually reduce the amount from your paycheck. A few individuals have the right to claim an exemption from withholding any money if the individual did not have any liability the previous year and the person expects to have no tax liabilities the next year.

W2 Vs W4: Major Differences Between The Two

Both the W2 and W4 Forms are related to the employees of the business. If an employer wants to fill out the W2 form, the information an employee provides in the W4 form is necessary. Although they are related, they still serve different purposes. Here are some of the major differences between W2 and W4 forms:

- The employer needs to fill out a W2 Form, while an employee needs to fill out the W4 Form.

- The information provided by an employee in the W4 Form helps the employer know how much to deduct as taxes from the employee’s paycheck. On the other hand, the W2 Form allows the employer to inform the IRS about an employee’s paid compensations and taxes withheld.

- Employees need to fill out the W4 Form after the hiring process, and their withholding changes anytime. However, an employer needs to fill out the W2 Form for every tax year and file and distribute the form by 31st January of the next year.

- Employers need to hold on to the W4 Form and do not need to file it. But, the employer needs to file the W2 Form with the United States Social Security Administration (SSA). Furthermore, an employer also distributes copies of the W2 Form to its employees.

Frequently Asked Questions!! (FAQs)

Ans. The most important difference between W2 and W4 is who fills the form. An employer needs to fill out Form W2, while an employee needs to fill out Form W3. Furthermore, the W4 also tells an employer how much amount to deduct from an employee.

Ans. The W2 Form is called the Wage and Tax Statement. Here, the employers need to fill out the form as a statement of compensation that they pay to the employees and the taxes they withhold. The employers need to submit the form to the IRS (Internal Revenue Service).

Ans. The Form W4 is called the Employee’s Withholding Certificate. An employee needs to fill out this form as an instruction of how much amount the employer can withhold from the gross paycheck. They do this at the time of hiring one employee. The employer does not need to file this form with a tax agency.

Ans. Yes. It is compulsory for an employer to employ an H-1B worker as a W-2 employee. Hence, in the case of an H-1B employee, filing a W2 Form is applicable.

Wrapping Up

Hope this article was helpful for you in answering your question on “W2 vs W4” and in getting a better idea of the major differences between the two forms. As you can see from here, an employee needs to fill out the W4 form, while an employer needs to fill out the W2 form. Furthermore, when it comes to filing tax returns for an employee and an employer, the IRS requires only the W2 form. Do you have further information about these two forms? Share some details with us in the comments section below.

Continue Reading:

Leave A Comment