Before you choose restaurant business loans, always consider whether they meet your business’s specific goals. Different options are available based on restaurant owners’ needs. Hence, to learn more, read on to the end of the article.

What Are The Best Restaurant Business Loans (2024 Updated)

According to Investopedia,

“Restaurant business loans provide working capital to buy equipment, hire employees, or pay your bills during a slow time. Plenty of funding options exist, from direct to alternative lenders. However, your interest rates and term length will vary by loan type, credit score, and revenue. Selecting an online lender can get funds into your account within days, whereas traditional bank lenders may take weeks.”

The best restaurant loans help to meet the short-term and long-term needs of a restaurant business. Some of the basic needs for which restaurants look for loans include:

- Requirement of working capital

- Property purchase

- Restaurant construction and renovation

- Purchasing equipment

- Doing fixtures and furnishing

To get to know the best loan options, read the subsections below.

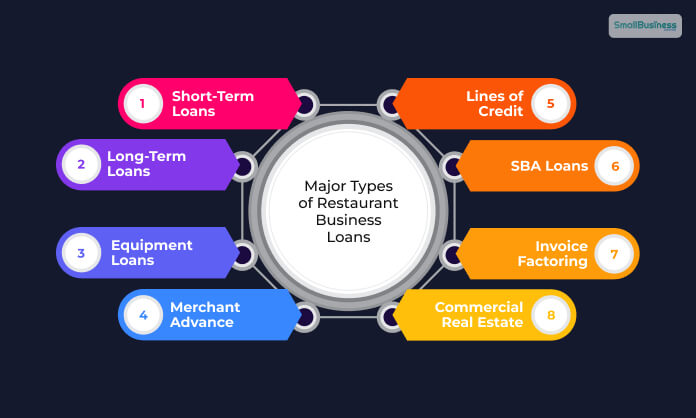

What Are The Major Types Of Restaurant Business Loans?

There are different types of restaurant loans. You can decide which loan you need with a financial advisor or the lending partner of the loan. The following are the different types of restaurant business loans you need to learn about:

Short-Term Loans: These loans have terms of six to thirty-six months. Generally, you have to repay the loan amount weekly or daily.

Long-Term Loans: These loans include secure funds, and the payment terms can extend to thirty years.

Equipment Loans: These are loans through which restaurants buy equipment, vehicles, and software.

Merchant Advance: Here, you make payments on the basis of your percentage of sales.

Lines of Credit: You only pay for the amount that you use for the loan. Once you pay off the extra amount, you can access more funds.

SBA Loans: These loans have government backing, and the payment terms are friendly.

Invoice Factoring: Here, you get a loan on unpaid invoices. After you collect the money, the lender receives the payment.

Commercial Real Estate: These loans are for purchasing property for your restaurant business.

The Best Restaurant Business Loans: Top Five

The following are some of the best business loans you can check out for your restaurant business:

1. Fora Financial

This is one of the best restaurant business loans overall. The lender offers you restriction-free funds. Here, you can also get approval within 24 hours.

| Pros | Cons |

| One of the fastest financing options No requirement for a minimum credit score You can avail of early payment discounts | There can be high loan fees and interest rates If you chose the revenue advance option, you might have to pay daily or weekly |

2. Fundbox

If your restaurant business is slowing down, you must choose Fundbox. Basically, Fundbox offers a flexible line of credit. You can access this credit whenever you need it, and you must only pay for what you use.

| Pros | Cons |

| The minimum credit score is low at 600 There is no penalty if you pay off early You will also not have to pay origination fees | You can get funds only up to $150,000 Requires business lien |

3. OnDeck

If your restaurant needs quick cash, then OnDeck is the best option, as it offers short-term loans. The loans range from $5,000 to $250,000. You can apply the funds for various expenses as well.

| Pros | Cons |

| A great option to build your business credit You can also get funding on the same day | You have to apply a personal guarantee Only businesses with annual gross revenue of $100,000 can qualify Some states like Nevada, North Dakota, and South Dakota are not eligible |

4. SBA 7(a) Loan

If you need big finance, SBA loans are some of the best ones. The SBA 7(a) loan can offer you financing up to $5 million. If you have large expenses like buying real estate for the restaurant or new equipment, this is the best option for you.

| Pros | Cons |

| There is a maximum limit on the rate of interest The repayment terms are lengthy | If you choose a loan over $25,000, you have to keep a collateral The funding time is generally lengthy |

5. SmartBiz

If you are getting an SBA loan, most funds have SmartBiz. Basically, 90% of SmartBiz’s referrals get qualified.

| Pros | Cons |

| As compared to a conventional SBA loan, you will get quicker funding As compared to other lenders, you will get competitive rates When you apply for a loan, you will get helpful customer support | You need to be at least three years in your business The government requirements are stringent You have to provide a personal guarantee and business lien |

Some Other Restaurant Business Loans You Can Check Out

Here are some more restaurant business loans you can consider:

1. Funding Circle

A restaurant with a good credit score avail of many options from Funding Circle. Here, you have the option to choose from different loan options. Apart from that, you can also get good customer service.

| Pros | Cons |

| In most cases, interest rates are fixed with fixed monthly payments A great option to build your business credit | You need a solid credit score The business must be at least two years old It requires a personal guarantee You have to keep a lien on your business assets Lack of transparency on interest rates Not available in the state of Nevada |

2. Credibly

This is a great option, even if you have a poor or below-average credit score. With Credibly, you can get an approved loan and funding on the same day.

| Pros | Cons |

| You only need a credit score of 500 to qualify for the loan There are a range of loan options to choose from There are no hidden fees in the loan | If you have poor credit, there are factors like high-interest rates, etc. In some cases, loans require daily or weekly payments |

3. Bluevine

If you need an extra infusion of cash for your restaurant business, Bluevine is one of the best options. It offers a line of credit up to $250,000, which you can apply for a variety of purposes.

| Pros | Cons |

| Funding is quick You only pay for the part that you use from the funds | The business needs to have a higher credit score (625 or above) It must be in business for at least two years There can be a weekly repayment schedule To qualify, your business needs to have a monthly revenue of at least $40,000 |

4. Crest Capital

With Crest Capital’s help, you will have the freedom to manage your expenses. Also, there are no hidden costs on the loan. Furthermore, if your equipment financing is less than $250,000, you will get a 4-hour turnaround time. Hence, such factors make this loan one of the best ones.

| Pros | Cons |

| There are many options for loans and lease You will get 100% equipment financing as well as loans for soft expenses Approvals and funding are fast | You need to have good credit if you want to qualify Not suitable for startups A lot of paperwork for loans over $250,000 |

5. ARF Financial

ARF Financial enables its borrowers to choose from its short-term loan options. Apart from that, the borrowers can also receive their funds within five days without keeping any collateral. The following are some of the major pros and cons of ARF Financial that you need to learn:

| Pros | Cons |

| If you pay off your loans early, you will get discounts on the principal and the interest. There are various loan options to choose from. The loan terms mainly range from 12 months to 36 months. | Generally, the interest rates on the loans are high. To pay off the loan, you need to make weekly payments. You will receive loans on the basis of the percentage of your annual revenue. |

Wrapping Up

Hope this article was helpful for you in getting an idea of the best restaurant business loans. However, before you choose a loan option, evaluate whether the lender suits your needs and demands. Also, go through the pros and cons of the loan options before you make your decision. Do you have more information to add on the loan options? Consider sharing them with us in the comments section below.

Continue Reading:

Leave A Comment