Westlake Financial is an auto-loan company that started its operations in 1988. Its current headquarters are at 4751 Wilshire Blvd #100, Los Angeles, CA 90010 USA. As of April 2023, this auto-loan company provides services across 48 US states, including Washington, DC.

To learn more about this company, like how to apply for a loan and whether you should do it, read this post until the end.

Westlake Financial: Overview

This company is an auto-loan specialist, where you can get insurance and loans for your automobiles. Westlake Auto Loans gives these loans to clients when they decide to buy a car. The loans they provide include your new vehicle’s transportation costs and insurance.

Auto loans from Westlake Financial may provide prospective purchasers alternatives when they wouldn’t otherwise have any. You don’t need a minimum income or credit score to be eligible for financing via Westlake, which is provided through a network of more than 50,000 new and used auto dealerships. What you should know before applying is as follows:

- Competitive Prices: High credit score consumers can benefit from Westlake’s competitive rates, which start at 4.99% APR and go up to $50,000 in loan amounts.

- Fewer limitations: Buyers having poor credit, open or prior bankruptcies, or previous repossessions will be considered by Westlake. Additionally, there are no minimum income or tenure requirements for jobs to be eligible for a loan.

- Quick approval process: If qualified, borrowers can get fast loan approval.

- Best for credit-challenged borrowers: Strong credit customers can take advantage of Westlake’s low rates, but this lender is ideal for those with terrible credit. A Westlake Financial loan can be an excellent option for borrowers who can’t acquire another loan because it has no minimum income or credit score criteria.

Westlake Financial Auto Loans

If you wish to take a car loan from Westlake Financial, you must follow a few steps. You are at the right place if you need to learn these steps, as this is what this post is about!

Westlake Financial has four primary loan plans:

| Plan | Credit Score |

| Standard | 0 – 599 |

| Gold | 600 – 699 |

| Platinum | 700 – 749 |

| Titanium | 750+ |

How To Get A Westlake Financial Auto Loan?

Here is the process you must follow to get an auto loan from Westlake Financial.

1.First, Visit The Westlake Financial Official Website

The first thing that you need to do is to visit the official website. Once you enter the website, you can search for the cars you want. Even if you don’t want to buy a car, you can check them out if you wish to sell yours!

When you see cars here, you can check out various options that come with them. This includes selecting which body color you want, additional car accessories, and the location it should be delivered to.

Once you select the preferred options, you will get a list of all the current prices of the cars, what terms and agreements you need to know about, and how you need to pay. Here, you will get detailed information about the loan you can get from the company, its interest rate, and in what installments you need to repay it.

2.Next, Submit Your Loan Application

One of the best things about taking auto loans from Westlake Financial is that you don’t need to present your Social Security Number. Yes, you heard that right. This means that taking an auto loan from Westlake Financial will not affect your credit score.

But why won’t it affect my credit score? This is because your credit score is managed using your Social Security Number, which is not used here.

When you fill up your application form, you will have to provide various details like:

- Name

- Current residential address

- Your job description

- Current income (salary per month)

After you complete your auto loan application form, the website will redirect your application to various car dealerships. Soon, if any car dealership accepts your loan proposition, they will contact you in a few days.

3.Finally, Compare All Offers That You Will Receive

Since your application form for an auto loan has been sent to various dealerships, expect to get a call shortly. You will definitely get a call as long as a dealership has accepted your loan payment proposal.

Soon, when they call, you can modify various options like the loan payment plans and other details if they ask.

After changes have been made, the final details of your loan will be presented to you. The dealership might call you to their office or do it online (depending on the dealership).

Here comes the sad truth, which contradicts the point above – the dealership will check your credit score. What does this mean? You will need to show the dealership officials your social security number.

Therefore, the dealership will thoroughly examine and analyze your credit score. If they find your score to be satisfactory, then only they will move forward with giving you the loan.

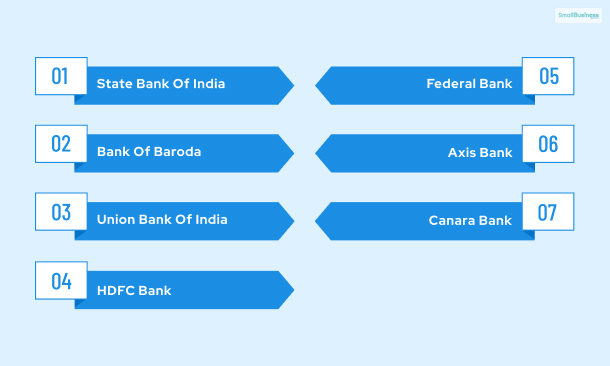

Top Westlake Alternatives You Must Know About

Westlake is one of the leading auto finance brands in the world. However, it is not the most accessible auto finance brand in India. As a result, Indians need to understand that there is a dire need for Indians to know about accessible financial institutions. Here are some of the most prominent auto finance brands in India that you need to know about.

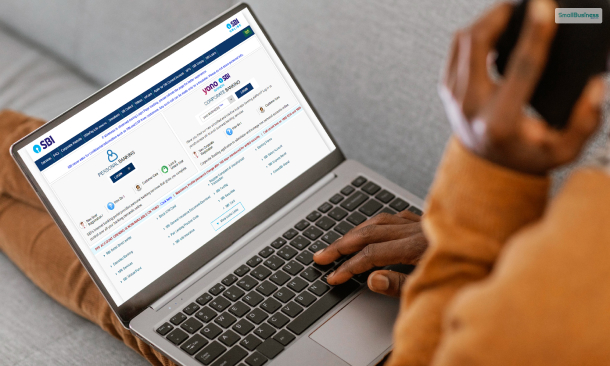

State Bank Of India

SBI or State Bank of India might receive a lot of flak, but it is easily one of the finest financial institutions in the whole country. SBI has one of the lowest interest rates in the market. As a result, the bank has been the staple for loan seekers in the country.

Bank Of Baroda

Bank of Baroda is another mainstay for Indian financial needs. This is a government-owned bank that has proven itself reliable and capable of handling all the financial needs of Indians. Bank of Baroda offers loans at attractive rates and fewer contingencies. As a result, the bank is preferred by many for commercial as well as personal loans.

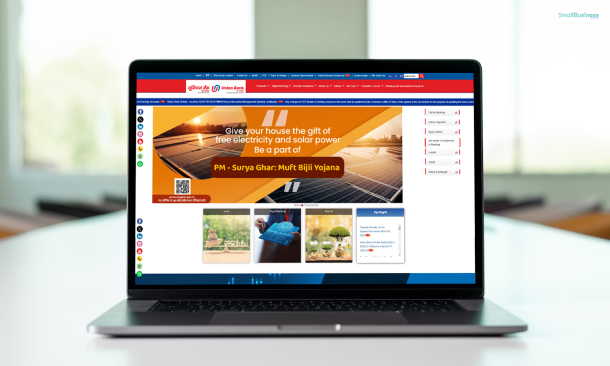

Union Bank Of India

Union Bank of India is a government-owned bank. Since it is a government-owned bank, the interest rates for the loans are lower than privately owned banks. Therefore, you can easily avail loans from the bank with nominal contingencies and interest rates. The bank charges around 10% of the skiing price of the car. Therefore, you can quickly pay it off in no time

HDFC Bank

HDFC Bank is a privately owned bank that offers interest rates and conditions like a government-owned bank. As a result, many Indians are actually opting to gravitate towards banks like HDFC. The bank allows flexible loan repayment options. This great feature will enable people to repay their loans with ease and comfort.

Federal Bank

Federal Bank has been in the banking business for a reasonable amount of time. As a result, it has eventually become one of the most trusted banks in the country. Federal Banks offer car loans to people who fulfill some basic requirements. However, the best part of the whole deal is that there is no penalty if you miss one or two payments. This allows families to be flexible with their repayment.

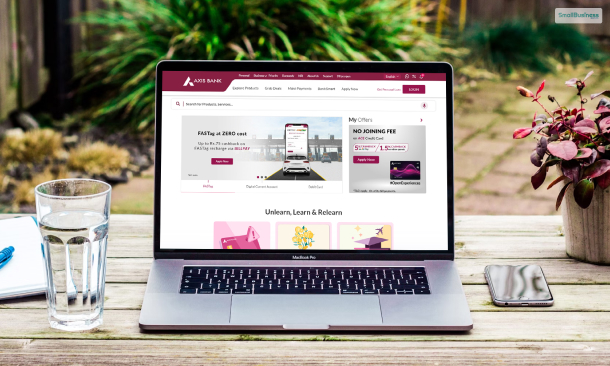

Axis Bank

Axis Bank is known as the paragon of banking in India. The brand has successfully turned into a multinational banking giant with branches all across the world. Axis Bank allows its customers to use their well-made banking application to take advantage of banking functions. As a result, you will not have to go to the bank to track a loan’s status. This makes the whole deal more accessible.

Canara Bank

Canara Bank is the final competitor of Westlake Financial in India. Canara Bank has established financial functions all across the country. This allows the bank to stay connected and in sync with its customers. Which in turn adds to the overall experience. The bank offers all the modern services that you might expect from an auto loan firm. Therefore, you do not have to worry about a single thing.

Westlake Financial: What Do The Customers Have To Say?

Money matters are risky. You must not take any steps when it comes to your financial health. Ending up in financial turmoil because of impulsive decisions does not sound right.

In this article, we have intensively discussed Westlake; there is one thing that will add more credibility to our words and clear your doubts if you have any.

Customer reviews play a very important role when it comes to financial matters. Financial institutions can be tricky, and you may not be aware of their norms unless you sign the deal. This may land you in trouble.

To keep you safe from that, here are some of the customer reviews that will help you get a clearer picture of their services and offerings.

Jaime was very helpful with paying off my loan and obtaining the correct information to send back to me. I also needed a letter stating there is zero balance owing, which he was more than helpful. – April A, US.

My service today with a phone representative was outstanding. He stayed on the phone with me to make sure my payment was received; he was very patient and eager to help me. My name is Leslie Smoot. Unfortunately, I didn’t catch the rep’s name, but he was extremely helpful. – Leslie Smoot, US.

It is quite clear from these two reviews that the representatives attending these two customers were very kind and cooperative. For any company to connect well with their customers or potential customers, it is important that employees are well-behaved and patient with the customers who reach out to them. It is natural for customers to be unaware of a lot of things, especially finance; therefore, it is the job of the employees to make them understand every nook and crook.

However, these are not just it. Compared to the positive reviews, the negative reviews exceeded by a huge margin. Let us now see what bad things the customers have to say about Westlake.

This finance company works with car wholesalers that purchase auctioned cars. These cars are primarily junk and cost you thousands immediately. Then, you are stuck with the loan, having to get rid of the car due to excessive repairs. Secondly, they don’t allow refy after six months. Thirdly, if you change your payment date, they still charge you late fees based on the original payment date. Horribly unethical company. – Debra-Ann Kretschmer, US.

This company charges TERRIBLE interest rates even for customers with GREAT CREDIT. I recently financed a used car through Westlake on a 36-month repayment plan, and even with an 800+ credit score, I was charged 11.49% APR. Luckily, I paid the vehicle off within 30 days, and NOW they cannot seem to understand what a $0 balance letter is. Terrible company!!! – Gordon Beckam.

Final Verdict: Is It Beneficial To Apply For Westlake Financial Loans?

Even though Westlake provides auto loans to customers with bad or no credit, doing so can be expensive because the APRs can rise as high as 29.99%. Conversely, you could value the ease of dealing directly with the dealer rather than with a different lender if you prefer to manage buying and financing your vehicle in one location.

If your credit score is good enough, Westlake loans may provide benefits, including payment deferral choices, a one-time monthly payment due date adjustment option, and no down payment requirements.

It’s crucial to remember that the Consumer Financial Protection Bureau (CFPB) only received 700 complaints regarding Westlake Financial auto loans in 2022. The lender does not have a Better Business Bureau accreditation, and despite receiving a “B” grade, consumers have given it one star out of five, with over 500 complaints made in the previous 12 months.

| PROS | CONS |

| You can apply even if you have a 0 credit score. You can be unemployed and still get this loan.No down payment if you have a 750+ credit score.If you have financial troubles, you can defer your payments. | The company has a history of illegal debt-collection practices.Once you take a loan from here, you can only get loans from partnered dealerships.No direct lending. Everything is done through third-party dealerships.You might have to pay the dealership some extra charges (depending on the dealer). |

Explore More:

Leave A Comment