If you want to start your business or you want capital to grow your business, the Small Business Administration offers SBA loans. Apart from that, SBA also helps small businesses to get federal small business grants. Furthermore, SBA also provides small businesses with resources and counseling to receive loans faster. The SBA is a body under the federal government that helps small entrepreneurs start and build their businesses.

In this article, you will learn about the United States Small Business Administration (US SBA). Furthermore, this article will also show you the workings of the SBA. Apart from that, you will also learn about the different types of small business loans that SBA offers. Finally, this article will also discuss how the SBA offers training and assistance to businesses and how it disseminates tools and information.

What Is Small Business Administration (SBA)?

According to Investopedia,

“The Small Business Administration (SBA) is a U.S. government agency designed to bolster and promote the economy by assisting the country’s small businesses. Established in 1953, the SBA’s primary function is to counsel individuals who want to start and grow their own businesses. It provides a series of tools on its website to assist new and existing small business owners.”

Basically, the Small Business Administration (SBA) helps businesses to grow or helps entrepreneurs start their businesses. They do so by providing loans and counseling to small businesses. Apart from that, it also offers online tools and training programs, apart from funding to enable small business owners to grow and others to start their businesses.

With the help of the SBA platform, the government lets lenders and borrowers come to the same place. The platform basically offers a guarantee to lenders that they will receive the money that they lend to borrowers. To borrowers, the SBA offers assurance that the lenders present on the SBA portal are safe.

To small businesses (borrowers), the SBA basically helps them get loans. Also, they offer grants for small businesses. Apart from that, they provide tools, training programs, in-person counseling services, and more. The focus is to help small businesses grow or help new business owners start their businesses.However, these funds are for those businesses unable to obtain funds from traditional financial sources.

The following are the ways in which the SBA helps small businesses:

- Starting new businesses

- Winning state contracts

- Access to advice in areas like management and finance

- A broad range of management services – consulting, courses, training, publications

- Support services and special programs for economically/ socially deprived entrepreneurs, minorities, and women.

How Does The Small Business Administration (SBA) Work?

According to the Corporate Finance Institute,

“The Small Business Administration (SBA) is a federal agency of the United States that serves small businesses. It provides financial assistance to small businesses that are unable to obtain funds on rational terms from normal lending sources. Such assistance comes in the form of guarantees on the loans secured from the private lenders.”

This US agency consists of an administrator at the helm, followed by a deputy administrator. Apart from that, it also has a chief counsel for advocacy, as well as an inspector general. The US Senate provides confirmation to these posts. You will find at least one SBA office in every state in the country, as well as on various American territories.

One of the most visible elements of SBA is its loan guarantee program. However, apart from the loan programs, the SBA offers a lot of educational information to small businesses. The major focus here is to help businesses grow and develop as per the needs and demands of the market conditions. In addition to that, the SBA also offers a small business planner, as well as additional training programs.

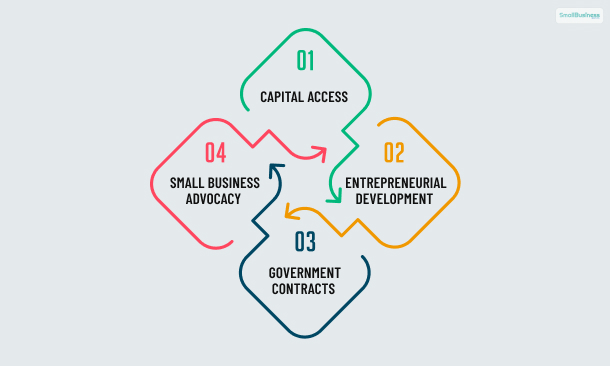

What Services Does The Small Business Administration (SBA) Offer?

The SBA helps several small businesses throughout the United States so that the latter can get access to loans, contracts, loan guarantees, and more services. According to the official website of the SBA, it offers the following services:

Capital Access

The SBA provides different financial resources for small businesses. These financial resources include small business loans, microlending, etc. The SBA issues these loans to those small businesses that find it difficult to qualify for traditional loans. Hence, SBA provides a platform where partner banks, lenders, and credit unions come together to provide loans to small businesses. In return, SBA offers these lenders with a repayment guarantee.

Entrepreneurial Development

The SBA also offers counseling services and low-cost training to businesses (both new and existing ones). These training and counseling services are present in 1800+ locations in the United States. Apart from that, the SBA also offers a mentorship program. With this program’s help, small businesses can easily connect with existing or retired entrepreneurs to learn how to grow and develop businesses.

Government Contracts

As per its policies, the SBA reserves 23% of its government contracting dollars for small businesses. They do it with the help of federal departments and agencies. Out of these, the SBA guarantees 5% of these government contracting dollars for women entrepreneurs and 3% for disabled/veteran entrepreneurs.

Small Business Advocacy

Apart from offering loans and resources, the SBA acts as an advocate by reviewing legislation for small businesses. In addition to that, they also act to protect the interests of small businesses all over the country and its territories. Furthermore, the SBA also advocates the growth and development of business owners at both federal and state levels.

Small Business Administration (SBA) Loans: A General Overview

According to Indeed.com,

“The Small Business Administration offers a variety of financial resources, including small loans for business owners who would not otherwise qualify for a loan. In the microloan program, the SBA loans money to nonprofit lenders, who, in turn, provideloans of up to $50,000 to the small business owners. This program includes other services as well, such as technical help, marketing and management guidance for borrowers.”

Apart from that, the SBA offers loan guarantees to small businesses. In this case, they work with a network of financial institutions (mostly banks), and they strive to provide loans to small business owners. With the help of the loan guarantee program, small businesses get better access to higher loan terms than banks. This is because the SBA offers a partial repayment guarantee to lenders.

In such cases, SBA Lenders (or providers of the loan) get the assurance that even if the small business becomes a defaulter on the loan, the lenders will still get some amount of the capital. Hence, there is a good chance for small businesses to receive loans with the SBA. Although the SBA does not guarantee a full repayment of the loan, it can cover up to 85% of the total amount of the loan.

Major Types Of Small Business Administration Loans (SBA Loans)

The following are some of the major types of Small Business Administration loans (SBA Loans) that you need to learn about:

1. SBA 7(a)

The 7(a) is the most popular SBA loan program, and the maximum loan amount is $7 million. Here, businesses can use the funds for short-term as well as long-term working capital. In this case, the loan is available for those businesses that want to refinance current business debt, fix stuff, and purchase furniture or supplies. If you want to finance real estate, this is the best type of loan.

2. SBA Microloans

SBA Microloans are small fundings for businesses (mostly $50,000 or less). Various non-profit community organizations administer these loans. Here, the business that borrows a loan can use that loan for a variety of reasons – improve, develop, enhance, rebuild, repair, etc. The focus must be to cater to the needs and demands of the business.

3. SBA 504 Loan

Various Certified Development Companies (CDCs) administer the SBA 504 loans. These mostly include community-based partner organizations that work under the SBA. Here, too, the loan amount can rise as much as $5 million to $5.5 million. However, the business that borrows the loan must use it to fund fixed assets which are there to grow the business or create jobs.

4. SBA Community Advantage Loan

The SBA offers this loan to help small businesses that are present in “Undeserved Markets.” Hence, the lenders of these loans are based in certain communities and are mission-focused. Here, the maximum amount of the loan can be up to $350,000.

What Is a Small Business According to the SBA?

In general, a small business, according to the SBA, is one having less than 500 employees. Once your company has more than 500 employees, it is not a small business anymore. However, there are other factors to consider too – annual receipts of employees, industry, business revenue, etc. Furthermore, the size of a company’s assets also determines the size of the company as per the SBA.

For example, to calculate employees, the SBA takes the average number of the company’s employees for a given period. However, it considers the latest 24 calendar months for the business. Here, an employee is any individual in the organization who has a payroll. The employee can be a part-time employee or even a full-time employee.

On the other hand, the SBA also considers the company’s gross income and deducts the cost of goods sold. However, despite the consideration of these factors, the purpose plays a big role in determining the calculations. Here, SBA considers the calculations of three to five years of average receipts. If your company is not in business for five years, you should multiply the average weekly revenues by 52. This will give the average annual receipt of your company.

Apart from that, there are several other factors that the SBA considers. Here are a few:

- The company should be based in the US.

- It must have its primary operations in the US.

- It must be a profit-based organization.

- The organization must be owned and operated independently.

- It must be a minority company in a larger industry.

What Is the Importance of Defining the Size of a Small Business?

The goal of the Small Business Administration (SBA) is to promote the overall success of a US-based business. Here, the SBA defines what a small business is on the basis of the industry it is in. In doing so, it identifies the businesses that will benefit from the SBA’s financing opportunities and services.

Basically, if SBA identifies your business as a small business, you will be eligible for SBA loans, and also other small business loans. This identification can also help small businesses to get more government contracts. Apart from that, you will also have access to certain tools and benefits that will enable you to compete against big businesses in the market.

Hence, with the help of this designation, socially and economically disadvantaged businesses can succeed in the market. Furthermore, the SBA also provides counseling, training, and learning workshops to businesses. Also, they help those businesses to connect with federal buyers.

How Can The Small Business Administration Help Start Your Business?

There are a variety of aspects where the SBA can help you start or grow your business. Some of them include:

- It helps in planning for the business and doing proper market research.

- The SBA also helps you launch your business and offers resources accordingly.

- It also helps make your management efficient and trains you to implement effective strategies.

Pros And Cons Of Small Business Administration Loans

BankRate.com says –

“SBA loans provide small business owners with a low-interest, government-backed loan to help fund their businesses. […] There are a few different types of loans business owners can apply for. All loan types require that the business is for-profit and meets SBA size requirements. The right loan type for each business depends on its needs, size and purpose.”

The following are some of the major pros and cons of SBA loans that you need to learn before you apply for a loan:

Pros Of SBA Loans

Here are some of the major pros of SBA loans that will benefit your business:

- You will have access to different types of loans, based on the needs and demands of your business. Furthermore, there are also temporary loan programs for uncertain challenges faced by businesses.

- There is a government backing against the loan. This means that SBA will help you pay the loan if your business somehow becomes a defaulter on the loan. As a result, the lender gets more incentive to lend capital to small businesses.

- You will also get access to loans at favorable rates of interest. Basically, there are different rates available on different types of loans.

- The repayment terms of small business loans from SBA are also quite long. Here, once you borrow an SBA loan, the repayment term can extend up to 25 years. Furthermore, you will also be able to adjust these terms based on your ability to pay back the loan.

Cons Of SBA Loans

Here are a few cons of SBA loans that you need to be aware of:

- The requirements against a loan are quite strict. For example, if you have personal assets or money, SBA will want you to apply for one of the loans. Hence, if you have personal equity or other funding options available, you will not be able to borrow loans from the SBA.

- Once you apply for a loan, there are plenty of paperworks for you to fill out. Furthermore, you will also need to provide financial and management information for your business. Apart from that, in some cases, the SBA will also ask you to provide additional documents for the loan.

- There are some lenders who will ask you for collateral against the loan you borrow. For example, if you take the SBA 7(a) loan of over $500,000, you will have to provide collateral on the loan. There is also collateral for other types of loans.

- Another annoying feature of SBA loans is that you will need to wait for a long time before you receive a loan. Here, the waiting time might range from 36 days to 90 days from the time when you applied for the loan.

Final Thoughts

Hope this article was helpful for you in getting a better understanding of how the Small Business Administration (SBA) works and how it helps businesses get access to loans. However, you can see that there are certain pros and cons of SBA loans. Hence, make sure you are fully aware of how the SBA works before you apply for a loan.

Do you have more information to add on SBA loans? Consider sharing them in the comments section below.

Continue Reading:

Leave A Comment