The Google stock split date in 2022 was July 15. Alphabet (GOOG), Google’s parent company, did a stock split for the second time in the history of Google. The 20-for-1 stock split means that the investors of Alphabet will receive 19 shares in addition to every share they already own. Since 2014, this is Google’s first stock split.

Google Stock Split Date: When Is The Google Stock Split?

Google 20 for 1 stock split date was July 15, after the market closed, and the stock started to trade by July 18. The previous time the company split its shares was in 2014 when it split its share in the division 1998-to-1000. The stock split happened for three classes of shares – Class A (GOOGL), Class B and Class C (GOOG).

Google Stock Split: What Will Are The Predictions?

Many investors actually cheered the news of the stock split earlier in 2022. However, there are still concerns among some regarding the slowing down of the revenues in advertising. Apart from that, various macroeconomic headwinds had lowered the value of Alphabet’s shares to their lowest in 20 months.

In addition to that, by the end of October 2022, the two shares, GOOGL and GOOG, extended their year-to-date losses, which is almost 35% for each. This is after they have reposted their earnings for the third quarter. Hence, there have been some changes in the earnings of Alphabet. Later on, we will give you details about the predictions of the price of Alphabet’s shares.

Stock Split – What Happens When A Stock Splits?

A stock split is mainly performed by a corporate, where a particular company or an organization issues additional stock to all its shareholders at a certain ratio. The company determines this ratio as per the needs and demands of the company earlier.

With the stock split, the company increases the number of shares that are held by the existing shareholders of the company. This results in the reduction of the prices of the shares due to the increase in the stock split ratio. However, the total combined value of the shares does not change due to a split in the stocks.

Some of the common ratios of the stock split are 2 for 1, 3 for 1, etc., where the shareholders of the company receive additional one or two stocks each for every stock they own. The price of each of these stocks will fall. However, the total value of all the combined stocks will not fall. Depending on the owners and managers of the company, the ratio of the stock split is decided.

How Did Alphabet Perform A Stock Split Of 20-For-1?

With the stock split of Alphabet, Google’s parent company, the shareholders of Alphabet’s Class A, Class B, and Class C received 19 shares in addition to each stock they had. For example, someone holding 100 shares received 1900 shares in addition. This happened after the closure of the market on July 15 in 2022.

The ones that invested in Alphabet’s shares cheered the news of the stock split. As Class A shares of the company surged over 7.5% on the next day. It was the best intraday gain in the year 2022. Shareholders of Alphabet approved the plan during the Annual Meeting of Stockholders that Alphabet held early in June 2022. Here, they kept the stock split date at July 15.

The news came in February when Alphabet announced that its Board of Directors had approved. Declared the split in the stocks for three types of shares – Class A (GOOGL), Class B and Class C (GOOG). The Class A shares and the Class C shares are listed in the public markets, with the names GOOGL and GOOG, respectively.

However, the founders of Alphabet exclusive and some of the exclusive directors of the company own the Class B Shares. These shareholders do not trade their shares on various stock exchanges around the world. Apart from that, the Class B shares consist of 10 votes per share, while Class A shares have one vote each of them.

Why Did Alphabet Perform A Stock Split?

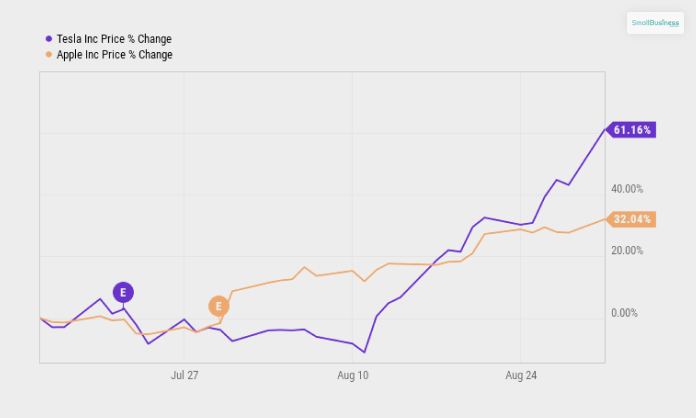

Most companies perform stock splits to make their stocks look attractive to investors. They do this to increase the prices of the stocks in the long run, as retail investors find the stocks more attractive. Top tech companies like Apple, Microsoft, Amazon, Tesla, etc., have announced stock splits. Some of them have even performed stock splits in 2022.

Just because a share of a company is pricier than another does not make the company more valuable. The market’s ability to capitalize helps determine the market value of a company. You can calculate this by multiplying of the total number of outstanding shares by the price of each share.

Stock splits do not directly affect the market capitalization of a company. Investors do stock splits by anticipating the retail interest after the splitting of stocks. Although the stock prices fall after the stock splits, they rise in a few months and increase the company’s market capitalization power.

After the announcement of the stock splits, the Class A (GOOGL) stock jumped to an all-time high of 10% at $3030/ day. Before it, the trading price of the stock was $2750. After July 18, the split-adjusted price of Class A stock was $112.64. The stock price of Google was $2255.34 before the stock split took place.

Final Thoughts

In this article, you mainly got to know about Google’s stock split date as well as the date of trading the stock, which was July 15 and 18, respectively. Apart from that, we also provided you with details regarding the reason for the stock split by Alphabet, Google’s parent company. Furthermore, you also learned about the effect of the stock split. And how the stock split of Alphabet increased the company’s market capitalization capability. Many experts and analysts were of the opinion that economic uncertainty and a stronger dollar were the main reasons behind the decision. What reasons do you think were behind the stock spit? Share your answer with us in the comments section below.

Read Also:

Leave A Comment