Every year, the IRS (Internal Revenue Service) makes changes to the federal standard withholding table. You can use these standard withholding tables to calculate your federal income tax (or employee wages). There is also the presence of the optional computational bridge of 2021 for employers to use, apart from the additional tax rate and bracket changes. Hence, to learn more, read on through to the end of the article.

In this article, you will learn about the federal tax withholding chart in general. Also, you will learn how to use it to calculate federal tax rates. Furthermore, we will also discuss various methods for determining federal income tax withholding of employees. Finally, we will also provide you with details on the major changes that happened in 2023 with the tax withholding tables.

What Is A Federal Tax Withholding Table?

According to the official website of Intuit QuickBooks,

“Federal withholding tables lay out the amount an employer needs to withhold from employee paychecks. This includes federal income taxes, as well as other taxes, such as Social Security and Medicare taxes.”

While setting up payrolls for your employees, it is important for you to consider going through the federal income tax withholding tables. This will enable you to withhold tax properly for your employees. If you have the right resources and support with you, it will not be a very difficult job for you to undertake.

However, things can get a bit difficult when the IRS changes tax rates, especially on a year-by-year basis. Hence, you will also need to stay on top of employment tax rates. This is because it is necessary for you and your employees. Moreover, learning about the updated tax rates will allow you to understand the amount of money you can withhold from your employee wages.

Understanding Federal Tax Withholding Tables

With the help of the federal income tax withholding tables, you (as an employer) will be able to find out how much money you must withhold from your employee’s wages. This is because you will need to pay this withheld money for federal income tax. To figure out how much to withhold for federal income tax, you can use the information in the employee’s Form W4, filing status, and pay frequency.

According to PatriotSoftware.com,

“New hires must fill out Form W-4, Employee’s Withholding Certificate, when they start working at your business. The IRS designed a new W-4 form that removed withholding allowances beginning in 2020…Form W-4 lets employees enter personal information, declare multiple jobs or a working spouse, claim dependents, and make other adjustments.”

You will first have to get information from a W4 Form filled out by an employee. Then, you will have a better idea of how much tax the employee wants you to withhold. Then, after knowing the employee’s data, you must refer to the federal tax withholding tables given in IRS Publication 15-T. Based on what the pay frequency of the employee is, as well as the employee’s filing status, and the way in which the employee fills out the W4 Form, you can check the federal income tax range.

Methods To Determine Employee’s Federal Income Tax Withholding

There are two major ways through which you can determine an employee’s federal income tax withholding capability. These are the Wage Bracket Method and the Percentage Method.

Once you find the adjusted wage amount of the employee, you must use the federal income tax tables that best correspond with the new IRS Form W4. You can use the IRS worksheet in Publication 15-T to perform this task.

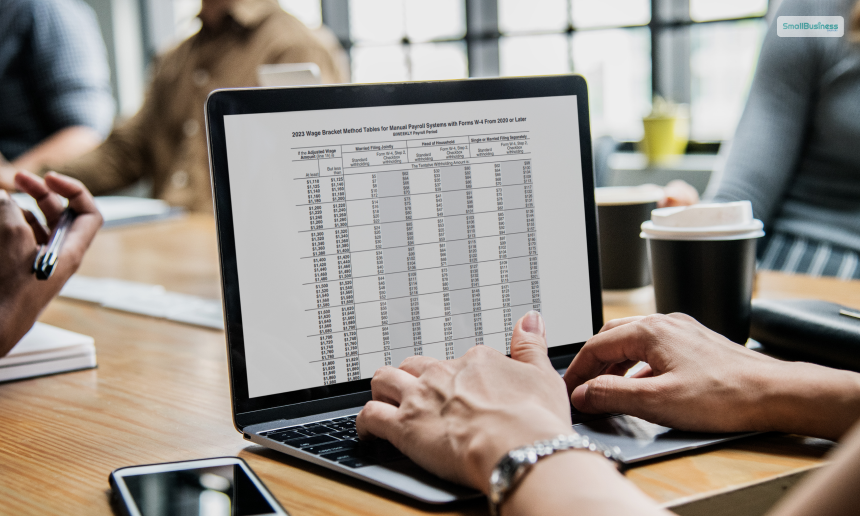

Wage Bracket Method

With this method, you will need to find the range in the table under which the wage of the particular employee falls. If the range is X, then the employee’s wage should be at most equal to X or less than that. Then on the W4 Form, find the amount that the employee wants you to withhold.

Percentage Method

According to PatriotSoftware.com,

“The percentage method is a little different. Like the wage bracket method, there is a range that an employee’s wages can fall under. But unlike the wage bracket method, there is a flat dollar amount and a percentage calculation to add together.”

Here are the steps that you need to follow to find out the withholding amount as per the percentage method:

Step 1: Find out the salary range of the employee (X or less than X) to find out the tentative amount you need to withhold.

Step 2: Find the percentage of the amount and add that percentage that the Adjusted Wage exceeds to the first step.

2023 Changes To Federal Tax Withholding Tables

Many changes that the Tax Cuts and Jobs Act 2017 brought forth remain the same between 2022 and 2023. The following are the things that remained the same from 2022 to 2023:

- There are no withholding allowances on W4 Forms of 2020 and henceforth.

- 22% is still the supplemental tax rate.

- The backup withholding rate remains the same at 24%.

- The personal exemption is zero.

- The computational bridge option is still available in 2023.

On the other hand, there have been various changes. This is because the federal income tax tables change every year with various changes in inflation. You will need to adjust your payroll tax withholding to reflect any annual changes to the income tax tables. However, if you use any online payroll software for withholding income tax, you will get automatically updated information.

Based on the version of Form W4 that your employee used to fill out the withholding information, you have to choose your federal tax income withholding table.

Wrapping Up

Hope this article was helpful for you in getting better information about how to use federal tax withholding tables to withhold tax for your employees while you are making payroll for your employees. As the IRS changes various data in the table every year, you will always need to update the payroll with every passing year.

However, we recommend you use an automated payroll system, as it updates the new tax rates on its own. Do you have any further information to add to this article? Share your views with us in the comments section below.

Continue Reading:

Leave A Comment