Have you ever come across a bounced check? In simple terms, did you face any situation where a bank rejects your check? In such a situation, you may tend to think, “Why did the check bounce?” Since everyone doesn’t know how to write a check correctly, it may get rejected for various reasons.

In this article, you will know what a bounced check is and what the reasons are that lead to check bounce. Learn them and avoid such mistakes so that your checks never get bounced.

What Is A Bounced Check?

Banks clear a check by giving or depositing the amount mentioned on the check to the payee. However, banks may reject or disapprove a check if there are some problems with the check, and it’s called a bounced check. Post that, banks will inform the issuer and payee about the rejection. The bank may also charge penalties to both the issuer and the payee.

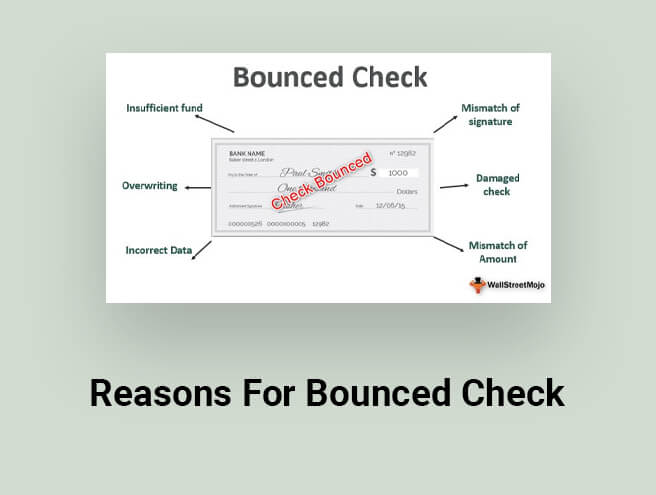

Different Reasons For Bounced Check

Now that you understand what a bounced check is. Learn more about why you can lead to rejection of your check and how you can avoid them.

1. Insufficient Funds

Having insufficient funds in your account is one of the prevalent reasons for a check bounce. If you don’t have enough funds, but you write an amount more than your bank balance on a check, banks cannot make the transaction due to insufficient funds.

In such a case, the bank may put penalties on both the issuer and the payee. So, you should ensure that you have funded more than the amount you write on a check.

2. Mismatch Of Signature

A signature is the most important part of the verification of a check. If the bank finds any mismatch or irregularity in your signature, it may reject the check. Banks will not accept a check with different or mismatched signatures that is available with the bank.

One of the main concerns people face while signing a check is the signature they had put at the time of opening a bank account may not be the same as their signature today.

3. Wrong Or Disfigured Date

The date of the check is an important part, and any mistake or error can lead to the rejection of your check. There are various reasons why a check gets disapproved due to the date.

Usually, if you scribble overwrite, or make any mistakes while writing the date, it may get rejected. So, you should be careful while putting the date on a check. To avoid this issue, you should verify it before depositing it to the bank.

4. Post-Dated Bounced Check

When you deposit a post-dated check before the due date, it may get rejected. Sometimes you may receive a check with a due date in the future, but if you deposit it before the due date, it will be dishonored.

For example, if the issuer writes a check today (30 March 2021) but puts a future date (4 April 2021), and you deposit it before 4th April, the bank will reject it. So, you should keep this in mind while depositing a post-dated check.

5. Mismatch Of Amounts In Numeric And Word Form

If there is any difference in the amount in numeric form and word form on the check, it may lead to a bounced check. If you have never written a check before, remember, that there are two spots on the check where you have to write the amount in words and in numeric form.

So, the amount you write in the numeric form must be the same as the amount you write in words. For example, if you write “150.00” in the numeric section, you need to write “One Hundred Fifty and 00/100” in the words section. Otherwise, your check may get rejected, for which you may have to pay the penalty.

6. If The Check Is Damaged

Another reason for check bouncing is submitting a damaged or worn-out check. When the check is not in good condition or the details are not clear, the bank may reject it.

No matter what the reason is, if there are stains or unclear information on the check, it may be rejected by the bank. So, it’s crucial that you keep the check safely and in proper condition.

7. Overwriting On The Check

There may be mistakes or errors while writing a check. However, you need to write a new check instead of overwriting or scribbling on the check. Banks will not accept overwritten or scribbled checks.

Giving a scribbled or overwritten check can lead to check-bouncing. Hence, you should not submit a scribbled check at the bank or give it to someone else.

What To Do When A Check Gets Bounced?

If you are ever in a situation where your check gets bounced, there are quite a few steps that you may take.

If you are looking for the same, here are the steps that you may follow:

Immediately Contact The Bank

No one can help you better with a bounced check than the bank itself. Once you see that your check is bounced, immediately call the bank; it is better if you visit. Even if the check was bounced at a time, there probably will be insufficient balance now. Ask the bank if they can try to deposit the check once again.

If there is still an insufficiency in the balance of the customer, ask the bank if they can run an enforced collection. This would mean that the next fund the customer deposits in their bank account goes straight to your account. This way, you will have the promise of the money from the bank account of the customer.

Call The Customer

The problem may be easily resolved just by contacting the customer.

Call them up. There is a chance that you could get their contact details from the check itself. Explain the whole situation to them. And then ask if they could make the same payment with credit or cash.

If you are not able to reach the customer via phone, you may try to send the bounced check letter to them. Tell them the reason behind the contact. Suggest to them the way and time by which they can pay you.

Get Help From The Government

You may get help from the police department of your locality or from the district attorney. They may help you with their services to track down those customers who write bad checks. These agencies may also help you collect the bad check funds. Customers may be more willing to pay if they sense a threat of prosecution.

Hire A Collection Agency

A collection agency could help you with the collection of the bad check. A collection agency may act on your behalf to make the customers pay, but they will charge a portion of the funds that you would receive.

When you take a collection agency on board, your work lessens considerably. And there is more of a chance that you will get the money without having much trouble. But, as there are added fees with hiring the agency, it is better to go to them at the very end once all of your other attempts have failed.

Seek Help From The Court

You may easily go to the small claims court to get the money back. Generally, this is preferred only when all your other options are exhausted. The small claims court could be time-consuming and expensive. This route may not as well be worthy enough if the check had relatively small amounts in it. But there is a fair chance that you may get more than what was originally written on the bounced check.

How Does a Bounced Cheque Affect a Small Business?

A bounced cheque can significantly affect a small business by influencing its creditworthiness. It can make it harder for them to get loans and credit lines later on. It can impact a small business’s reputation and potentially lead to issues if there’s a bounced cheque issue.

It can sometimes lead to potential loss of customers due to mistrust and also disrupt the cash flow. Sometimes, big cheques bouncing can affect operations as well. Here are the key points on how a bounced cheque can be a negative sign for a small business –

Credit Score Damage

A bounced cheque means damage to the small business’ reputation. When a cheque gets bounced, it reflects very poorly on the health of the business’ credit score. Later, he business might suffer to secure loans or lines of credit at an easier term.

Reputational Harm

Bounced cheques can put a solid red mark on a business. They start to have a ruined reputation among the suppliers and customers, which can later cause a loss of business. Also, in the end, it can cause potential loss of the business because of the perceived unreliability.

Legal consequences

Several jurisdictions are completely against issuing a bounced cheque because of insufficient funds. There are rules outlining such mistakes as criminal offenses, which can potentially lead to penalties. Small businesses issuing similar cheques can face several legal allegations that are difficult to get rid of.

Cash Flow Disruption

It’s critical to avoid potential reasons for cash flow disruption. Especially when the cash amount is significant, it can cause payment delays and cause several operational challenges.

Losing Customers

If any news of a small business issuing bounced cheques gets out, it causes damage to the business’s reputation. As a result, many customers start losing faith in the brand. It can cause a loss of customers, leading to a loss of revenue.

FAQs On Bounced Check

Now that you know different reasons for a bounced check, here are some common questions people ask about check bouncing.

-

What Is The Penalty For A Bounced Check?">What Is The Penalty For A Bounced Check?

The penalty may vary from one situation to the other. If you are paying a check for the repayment of a loan, the penalty is different when you are paying the check for the service bill. Again, the penalty may also vary based on your bank and state.

-

Can A Date Lead To a Bounced Check?">Can A Date Lead To a Bounced Check?

Yes, wrong or inappropriate data can cause a bounced check. Some common reasons for a check bounce due to date is any mistake or disfigurement of date. Again, if the date is overwritten or scribbled, that can also lead to check-bouncing.

-

How Does A Bounced Check Affect You?">How Does A Bounced Check Affect You?

A bounced check may have several negative consequences, such as a penalty to both the payee and drawer, affecting the credit score. Again, many cases have found that the payee filed a lawsuit against the drawer.

The Bottom Line

Hopefully, the above information has helped you to know about different reasons for a bounced check. So, you should take care of these things to avoid a check-bounce. Writing a check correctly and neatly is important, and you should also ensure that you have enough funds in your account before writing the amount. Lastly, if you have any queries regarding a bounced check, don’t hesitate to drop them in the comments section.

Read Also:

Leave A Comment