How to get approved for Apple Card? – This is one of the major questions that we come across on the Internet. If you are an iPhone user who is interested in Apple Card, you will need to qualify for it. However, it might come to your mind whether Apple card pre approval is possible or not.

In this article, you will find out about the Apple Card pre approval process and details about it. Furthermore, we will also give you details about the process of the Apple credit card application. In addition to this, you will also learn what you need for the Apple Card pre approval in the Apple Credit card process. Hence, to find out more about the topic read on through to the end of the article.

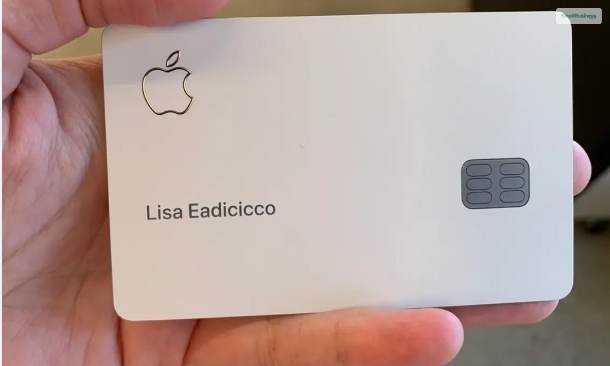

Apple Card: A Brief Overview

According to NerdWallet,

“The Apple Card is designed to work digitally. To start, you apply through the Apple Wallet app, though you can also apply for the Apple Card online after logging in with your Apple ID. If you get the card, you use the same app to make payments, track spending, and manage your cash-back rewards.”

Once you look at the car, you will see that it is made up of titanium. To receive the physical card, you will need to apply it separately, as you will not receive the card automatically. However, the physical Apple Card also earns a lower cash-back rate than the digital card that you use through Apple Pay.

What Are The Reward Categories Of The Apple Card?

You will get 1% cashback once you make purchases with the physical Apple Card. Furthermore, you will get 2% cash back on all purchases that you make with Apple Pay. However, the following are the categories in which a 3% cash back is applicable:

- If you make any Apple Pay purchases directly with Apple. These also include the purchases that you make on Apple Stores, App Store, or avail of any Apple service.

- If you purchase any Ace Hardware products through Apple Pay. This also includes the Ace Hardware app and website.

- It also applies to purchases from Exxon and Mobil gas stations, including fuel, car washes, and convenience stores.

- Apple Pay purchases from Nike (US Stores, official website, and Nike apps).

- If you purchase from Panera through Apple Pay

- For T-Mobile purchases through Apple Pay

- Apple Pay purchases in Uber and Uber Eats.

If you make purchases from Walgreens and Duane Reade via Apple Pay.

Apple Credit Card Apply – What Is The Process?

The Apple Card lets you access and use the card from your digital device and use it digitally. You can apply for the Apple Card through the Apple Wallet app on your iPhone. However, you will also be able to apply for it through Apple’s official website once you have logged in on the platform through your Apple ID.

According to Apple Support’s claims,

“Goldman Sachs uses your credit score, your credit report (including your current debt obligations), and the income you report on your application when reviewing your Apple Card application.” There are a variety of combinations that Goldman Sachs makes use of to decide whether an applicant is eligible for an Apple Card.

Once you get an Apple Card, you will still have to use the same app if you want to make payments. Using the app, you can manage your cashback and track your spending. Furthermore, you will also get many benefits once you use the app.

Once you apply for an Apple Card, you will not get the physical card, as you will have to request one. There is a lower cashback rate associated with the physical Apple Card, which is not available with the digital card.

However, you should not confuse Apple Wallet with Apple Pay; the former is an in-built app on Apple iOS, and the latter is a payment platform. To know more, click on the link.

Apple Credit Card Requirements

If you want to know how to get approved for an Apple credit card, you will need to go through the following major requirements:

- You have to be a U.S. Citizen or a resident of the country. You will also need to show your residential/ business address.

- You need to be at least 18 years old.

- You need to have a photo ID card to prove your identity.

- You will need to ensure that your iPhone or any other Apple device is able to run Apple Pay with ease. Hence, you will need to upgrade to the latest iOS devices.

Apart from that, once you apply, you need to have a 660 credit score, as Apple considers it a favorable number for Apple Card approval. However, someone who has at least a good score is also eligible for the Apple Card. Basically, Goldman Sachs issues the Apple Card. They use the FICO Score 9 model. This model ranges from 300 to 850.

Apple Card Pre Approval – Is It Possible?

There is a preapproval tool available with the online version of the Apple Card. This card will give you a good idea of whether your card is eligible for Apple Card pre approval or not.

However, U.S. News Money warns,

“be aware a preapproval is not a guarantee of actual approval. It’s based on just a snapshot of your credit on a specific day and time and on only preliminary information provided by you.”

What Credit Score Do You Need For Apple Card?

According to the official website of Apple Support,

“Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low (for example, if your FICO9 score is lower than 600), Goldman Sachs might not be able to approve your Apple Card application.”

Hence, consider keeping your credit score away from lower-level numbers.

On a side note, if you want to learn how to use Apple Pay and how it differs from Apple Wallet, click on the link.

If You Apply For A Credit Card, Do You Have To Accept It?

After you have applied for your Apple Credit Card and your application is approved, you will get thirty days to accept the credit card offer. However, if you accept the Apple Card, there will be a hard inquiry on your credit, and this might affect your credit scores. Furthermore, you will also get instant access to your Apple Card through your Apple Wallet.

Does Applying For An Apple Card Hurt Credit?

Not at all. According to Apple Support,

“If you apply for Apple Card and your application is approved, there’s no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn’t impacted by the soft inquiry associated with your application.”

Once they accept your application, there shall be no impact on your score. However, if your application is declined in the first place, you have to improve your next application.

Frequently Asked Questions!! (FAQs):

Here are some of the major frequently asked questions regarding Apple credit cards:

Ans. It depends on your credit history and financial information. You cannot qualify for an Apple Card pre approval if your credit history is not good. In such cases, the issuer of Apple Credit Card does not offer this option, and they will send you an email that explains the cause of the decline.

Ans. Goldman Sachs is the card issuer of Apple Card. They do not have a minimum credit score for any person. However, they expect a general credit score of 690.

Ans. Once your application is approved, the issuer will give you thirty days to accept the offer. After you accept, you will get instant approval and access to your Apple Card through your Apple Wallet.

Ans. Yes. The issuer of Apple Card will verify your income before offering you credit. For safety purposes, most credit card issuers verify the income of the credit card applicant before issuing the card.

Summing Up

Hope this article was helpful for you to know about Apple Card pre approval. Hence, as you can see, once you get an Apple Card, you will still have to use the same app if you want to make payments. Using the app, you can manage your cashback and track your spending. Furthermore, you will also get many benefits once you use the app.

Continue Reading:

Leave A Comment