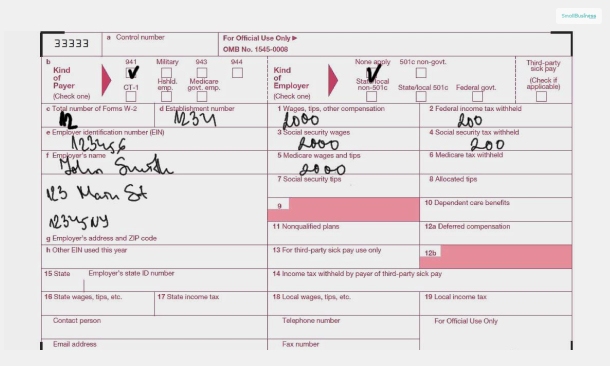

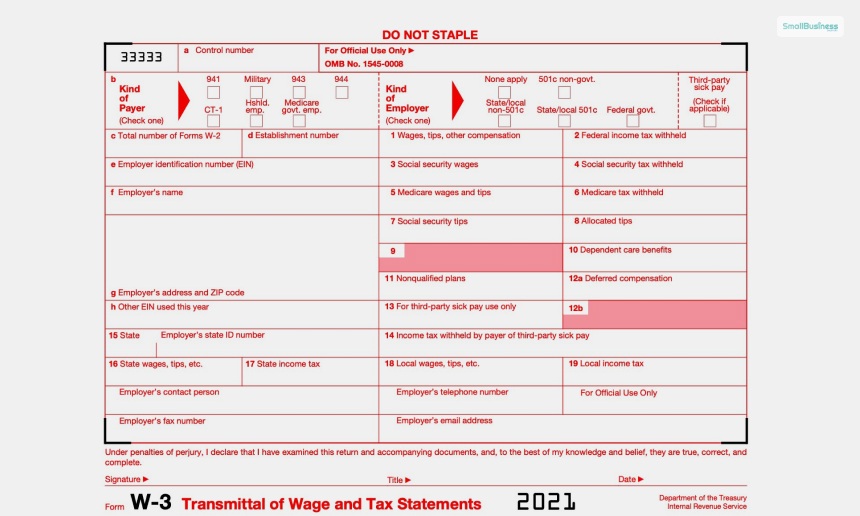

The W-3 Form contains information about the transmittal of income as well as the tax statements of employees. Employers use this form to report the total wages that have been paid to the employees and the total amount of taxes withheld from the employees. Basically, the W-3 Form is used to transmit the Copy A of Form W2. If you don’t get it, read along through to the end of the article.

In the first part of the article, you will learn some of the essentialities of the W-3 Form and the entities responsible for filing it. Furthermore, we will also discuss how the W-3 Form is different from the W-2 Form to ease the complexity. Finally, we shall offer you information about how to file a W-3 Form as an employer.

What Is The W-3 Form?

According to the Forbes Advisor,

“Form W-3, also known as Transmittal of Wage and Tax Statements, is a form that employers use to report the total wages paid out to all employees and the total taxes withheld from their paychecks during that tax year.”

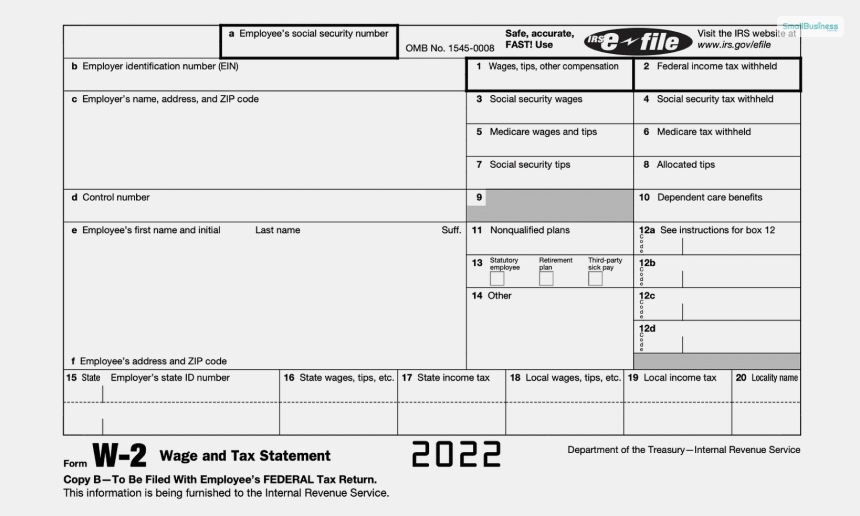

Basically, the W3 form helps summarize the information from all the W-2 forms of your employees that you, as an employer, are filing for that year. The information in the W2 forms, as well as the W3 form, should match. The filing of the W3 is done together with the W2 form, that is, by the end of the 31st of January. This will allow you to stay clear of legal issues related to tax liabilities.

To ensure proper filing of the information, the employer needs to send the W-3 Form to the Social Security Administration (SSA). Furthermore, even if there is one employee who is eligible for W2, the employer needs to file the W3 in that regard as well. This shows the importance of Form W-3 in the tax filing procedure.

Who Can File The W-3 Form?

According to the US Social Security Administration (SSA),

“Each year, employers must send Copy A of Forms W-2 (Wage and Tax Statement) to Social Security to report the wages and taxes of your employees for the previous calendar year. In addition, a Form W-2 must be given to each employee. Forms W-2 are sent to Social Security along with a Form W-3 (Transmittal of Income and Tax Statements).”

Hence, it is evident from the aforementioned information from SSA that between the employer and the employees, the employer is responsible for filing the information in the W-3 by sending it to the SSA. The IRS (Internal Revenue Service) regulates and cross-checks the filing information, which is a body under the United States Government.

What Are The Differences Between W2 And W3?

Since all the form names are similar, with the common “W” in all of them, it is easy to mix them up and complicate matters even further. Although W2 vs W4 is understandable, the employer needs to fill out one of them and must file it with the IRS, while the employee must fill out the other. The employee needs to add information so the employer can fill out the W2.

However, the problem arises between W2 and W3. It is easy to ask, “What is the use of the W-3 Form when I am already filling up the W-2 Form and filing the tax returns of employees to the IRS?” – In this case, you need to know that the W-3 Form contains the summary of the amount available in all the W-2 Forms. You need to send this form to SSA to ensure that it is filed properly.

How To File A W-3 Form? – Points To Note

You can file the W-3 Form just like the W-2 Form. The best way to file the forms is electronically. Electronic filing is mandatory in case of W-2 Forms that are more than 250 units. Here are the steps that you need to follow to file the W-3 Form:

1. Use The Business Services Online Portal Of SSA

Business Services Online is a useful feature provided by the government on the Social Security Administration website. It can basically help you by filling out the IRS W-3 Form once you have submitted your data related to the W2 Form. It works only for 50 W2 Forms (that is for 50 employees). However, consider checking the form properly before submitting it.

2. Start Using A Payroll Or Tax Software

There can be a situation where you have more than fifty employees in your organization. In such a situation, you will need to use payroll software, where you have details of all the employees’ paychecks. This can help you include all the W2 forms in the BSO. However, ensure that the format meets the SSA specifications.

3. Mail The W-3 Form

If you have less number of employees, you can mail the physical form W-3. You will just need to copy the data of W2 to W3. Here, FreshBooks.com recommends –

“Once finished, attach Copy A of each employee’s Form W-2 to Form W-3. It’s a common error to print and file Copy A of Form W-2 and Form W-3 from the IRS website. Instead, find approved red-ink versions of IRS Form W-3 and Form W-2 on IRS’s products page.”

However, if you have more than 250 W-2 Forms, you will have to electronically submit the forms, both W2 and W3, rather than mail them.

Bottom Line

Hope this article was helpful for you in getting a better idea of the W-3 Form, its uses, applicability, inside information, and how to file the form. The W-3 Form is basically a summarized version of all the W-2 Forms that you have of your employees. You will need to file a W-3 along with all the W-2 Forms.

If you want to file this form, consider following the steps that we have mentioned above in the previous section of the article. What steps do you recommend to make tax filings easier? Share your views with us in the comments section below.

Continue Reading:

Leave A Comment