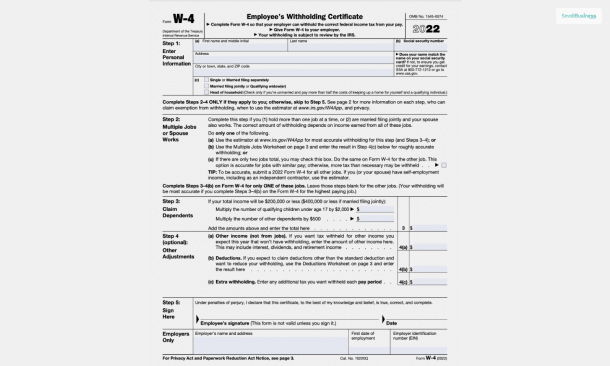

The W4 Form, also called the Employee’s Withholding Certificate, is a form provided by the Internal Revenue Service (IRS). Employees need to fill out this form to show their tax situation to their employers. Employees need to fill out this form at the start of their job and tell the employer what amount of tax the employee wants the employer to deduct from the gross paycheck.

In this article, you will learn some of the essential aspects of Form W-4 and its importance for employees. Furthermore, we shall also discuss the major updates within Form W-4 in 2023. Finally, you will learn how to fill out the form correctly. Hence, to learn more about Form W-4 and its uses, read on through to the end of the article.

What Is The W4 Form?

The Form W-4 of the IRS is also called the Employee’s Withholding Certificate. Here, an employee needs to specify what percentage, or what amount the employee wants the employer to withhold as tax money, from the employee’s paycheck. If you are an employee, you can specify the amount. Also, you will need to fill out the form at the start of the new job.

According to Investopedia,

“You need to complete a W-4 correctly because the IRS requires workers to pay taxes on their income throughout the year. If you fail to withhold enough tax, you could owe a large sum plus interest and penalties for underpaying your taxes to the IRS when you file your tax return.”

Let’s say you are an employee. The amount that your employer withholds from your paycheck is paid to the Internal Revenue Service (IRS). The employer pays the amount to the IRS using your name and your SSN (Social Security Number). Once you file your annual tax return, you will get credited with the tax amount that you paid from your paycheck throughout the year.

What Is The Importance Of W4 Form?

The importance of Form W-4 lies in the fact that it shows the data to the IRS about how much tax you have paid from your paycheck. If you pay more tax than you need to, you will get a tax refund. However, if you withhold the tax too much during the year, your monthly income will be reduced. Furthermore, you will not get your extra tax back until you file your tax return and receive the tax refund.

You can state how much tax to withhold from the paycheck based on your dependents, marital status, financial status, various exemptions, and some other factors. Furthermore, as you increase the number of allowances that you want to get as an employee, it will decrease the amount of money that your employing organization can withhold from your gross paycheck.

Moreover, as an employee, you will have the right to file a new Form W-4 any time your life situation changes. A few examples of such situations include marriage, divorce, an increase in dependents, having a child, and many more. As your status changes, the amount of tax withheld from you changes.

Do You Need To Update The W4 Form Every Year?

According to Nerdwallet.com,

“You do not have to fill out a W-4 form if you already have one on file with your employer. You also don’t have to fill out a new W-4 every year. If you start a new job, or want to adjust your withholdings at your existing job, though, you’ll probably need to fill out a new W-4.”

In this case, you will also need to make sure that you are using the latest updated W4 form.

For best practices, consider checking on your deducted taxes annually at a minimum. The Internal Revenue Service recommends taxpayers use the Tax Withholding Estimator available in the official IRS portal. This will allow you to check whether your tax withholdings are on track or not. The estimator also allows you to decide whether you need to make adjustments by filling out a new Form W-4 or not.

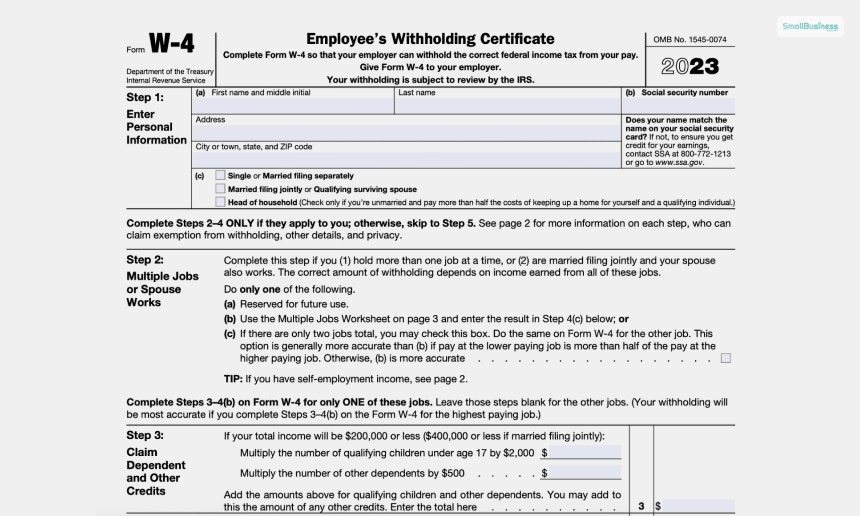

What Are The New Updates In The 2023 Version?

The following are the major updates that the IRS made in Form W-4 in 2023:

- The tax withholding estimator references are removed.

- There is a piece of additional information in Step 2(c) about who can use the checkbox for two jobs.

- There are updates with the amounts in the Deductions Worksheet for the year 2023.

The 2023 form does not mention using the IRS tax withholding estimator. However, you still have access to that estimator. Also, you can use it to see whether you need to adjust the amount in Form W-4 and by how much.

How To Fill The W4 Form?

The employers also make use of Form W-4 to calculate their payroll taxes. This will enable them to remit the taxes to the IRS, as well as the state and local authorities, on the employees’ behalf. The way you fill out Form W-4 is a deciding factor in whether you will owe taxes to the government or whether you get a refund. Hence, you will need to fill out the form properly. Here are the steps to follow:

- Step 1: Enter your personal information on the name, address, SSN, tax-filling status, number, and more.

- Step 2: If you have multiple jobs, here you need to fill up steps 2 to 4(b) of the form for the highest paying job. However, if you have two jobs and you make the same amount, check box 2(c).

- Step 3: To claim for dependents like children (if your income is less than $200,000), you can enter the number of kids/ dependents and multiply the number by the credit amount.

- Step 4: You can also choose the option to withhold an extra tax amount.

- Step 5: You must give the signed form to the HR team or the payroll team, depending on your organization’s system.

Bottom Line

Hope you have understood the uses and the importance of the W4 Form. You can see here that in Form W-4, as an employee, you can state the amount based on the filing status, dependants, deductions, anticipated tax credits, and more. You also need to complete a new W4 Form if there is a new employer. Do you have any further information about filling out Form W-4? Share some info with us in the comments section below.

Continue Reading:

Leave A Comment