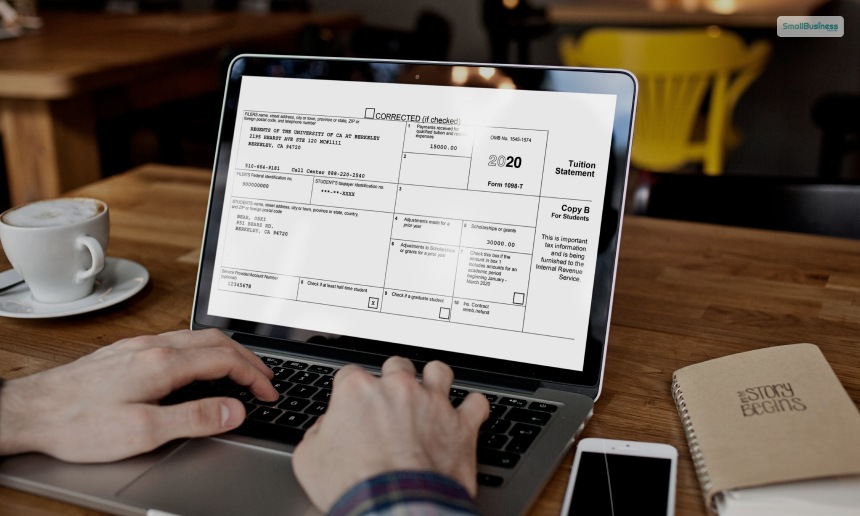

The colleges and post-secondary institutions that are eligible for the benefits send 1098 T Form to students who paid their “qualified educational expenses” of the preceding financial year. These education expenses include tuition fees, any other fees related to enrolment, and course materials that a student needs to be enrolled or attend the eligible institution.

In this article, you will learn in general about Form 1098 T and what are its constituents. Apart from that, you will also learn about eligibility. Furthermore, we will also share with you how to file this form and when to file it. In addition to that, we shall discuss some of the common mistakes one must avoid while filing the 1098 T Form.

1098 T Form Meaning – What Is Form 1098-T?

According to IRS.gov,

“Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.”

Basically, every student who pays tuition fees to eligible colleges and other post-secondary education institutions is eligible to receive a copy of the Internal Revenue Service 1098 T Form. They receive a copy every year and fill out the form to report qualified expenses for the preceding financial year.

After the student provides the information related to the educational expenses, the student may qualify to get the tax credits related to education. If the student is dependent on parents, guardian, or spouse, then the payer of the fees is eligible as well.

The eligible institutions for this form include most post-secondary institutions, colleges, universities, as well as other vocational schools. The educational institution has to be eligible to take part in the United States Department of Education’s student aid program.

How To Get My 1098 T Form?

Once you have paid for your educational expenses, you can get the form in the next tax year. The goal of the 1098-T is to help students and their families find out whether they are qualified enough to receive tax benefits given by the state. There are major tax benefits provided with collaboration between the federal government and the state government. Some of them include American Opportunity Credit or the Lifetime Learning Credit.

You will also have to provide information related to the financial help that you have received and also tuition fees and costs. Some of the common help that students receive includes scholarships and awards. However, you will not have to provide details regarding your travel, lodging, and other details that are not qualified for tax credits.

Who Are Eligible To Get The 1098 T Form?

If you paid qualified educational expenses in the preceding tax year, you are eligible to get Form 1098-T. The school is responsible for sending the form to the student who paid those expenses the preceding tax year.

According to the Intuit TurboTax website,

“If someone else pays such expenses on behalf of the student (like a parent), the student still gets “credit” for them and receives the 1098-T. Schools are required to send the form to the student by January 31 and file a copy with the IRS by February 28.”

The following are some of the expenses that are regarded as “qualified expenses”:

- Tuition fees of the school/ college/ university

- Enrollment fees paid by the student

- Fees for the course materials that the student pays to the institution

You can receive the form either through electronic means (like PDF) or a physical copy of the form. If you received the 1098-T Form electronically, you must take a print of the form. You must also fill in the details inside it relating to your educational expenses.

However, you will need to note here that not every educational institute will provide you with Form 1098-T mandatorily. If your educational institution is not eligible for the federal student aid program, then you will not be eligible to get tax credits on your educational expenses. To find out whether your educational institution is eligible or not, just ask the inquiry office inside the institution’s campus.

Common Mistakes Students Make While Filling The Form 1098-T

The following are some of the major mistakes students make while they fill out the 1098-T Form to get tax credits for educational expenses:

- Not reporting all the qualified tuition fees and related expenses that the student paid to the university/ college/ institution.

- Not reporting other scholarships and grants that the student received.

- Not receiving the 1098-T form by 31st January of the following year after making the educational payments.

- Failing to submit this form by the end of 28th February.

- Not properly providing the TIN number of the student.

Instructions For The Educational Institution

According to the IRS.gov official website,

“File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified tuition and related expenses.”

Hence, the educational institution is responsible for filing this form and not the student. The responsibility of the student is to fill up the form and submit it by 28h February to the school authorities. While the school’s responsibility is to send the form to the student by 31st January.

Wrapping Up

Hope this article was helpful for you in getting a better idea of the utility of the 1098 T Form. You can see from this article that the importance of this form lies in the fact that it provides students with tax credits for educational expenses. However, the student needs to be a part of an educational institution that is eligible for the federal student aid program.

The student needs to pick up the form from the school by 31st January and fill up the 1098 T Form by 28th February, and submit it to the school authorities. Do you have any more information to add here? Share your views with us in the comments section below.

Continue Reading:

Leave A Comment