The W2 Form is an important document that an employer is required to send to an employee as well as to the Internal Revenue Service by the end of the year. The form is also known as the Wage and Tax Statement.

In this article, you will mainly get to learn, as of 2023, the major changes that happened in the W2 Form. Furthermore, before that, we shall also give you some of the general details of the W2 Form, for example, what it is, who files it, and many more. Hence, to learn more about this form, its usefulness, application, and the various changes, read on through to the end of the article.

W2 Form: What Is It Actually?

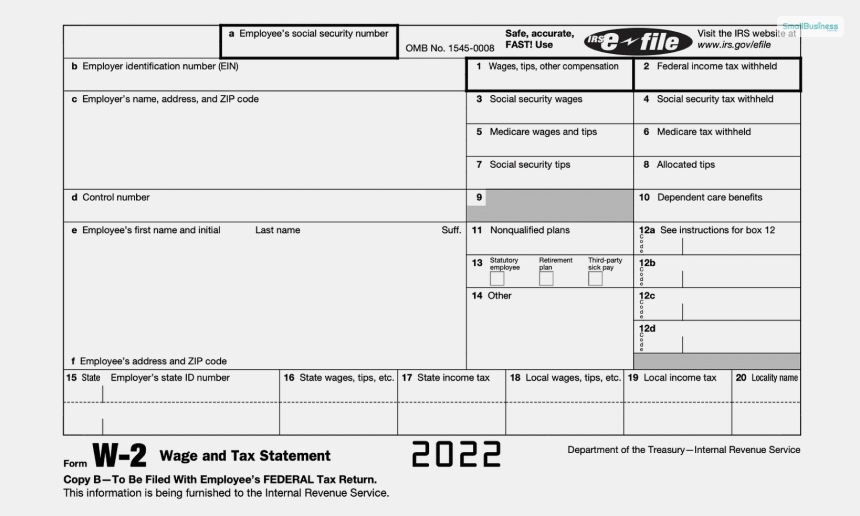

The W2 Form (also called the Wage and Tax Statement) contains the report of the amount of wages of a particular employee and the taxes withheld from that employee’s paychecks throughout the last year. The information is available to the government (to the IRS) as well as the employee.

An employer uses the W2 Form to report FICA taxes for employees. This is a legal requirement in the case of the employer. Moreover, the IRS (Internal Revenue Service) also uses the W2 Form to track the obligations of the individual.

On the other hand, this legal requirement is not applicable for employees on contract or even self-employed workers. For these types of employees, there are different forms available, with the help of which they can file their taxes to the government.

What Information Is Contained Inside Form W2?

This form is for reporting to the IRS the earnings and taxes of every eligible employee of an organization. The employers are responsible for submitting the form to the IRS. In this case, the taxes include federal and state income, as well as Medicare and Social Security taxes.

There are six copies of the IRS form. These are mentioned below.

- Copy A – filing with the SSA (Social Security Administration)

- Copy B is for the employee who needs to file their federal tax return to the gov.

- Copy C includes the earning records of the employee

- Copy D includes various records of the employer

- Copy 1 is for filing taxes with the State, City, or Local Tax Departments

- Copy 2 is for the employee as they need to file taxes with their state, city, or local tax return

The Major Changes That Happened In This Form In 2023

As per various information available for the IRS, here are some of the major changes that happened in the W2 Form:

- They made it more concise and compact.

- They redesigned the form in such a way that it takes a few pages.

- They removed some boxes to include Copy B, Copy C, and Copy 2 within the form.

- There are filing instructions available on a separate page as well.

- Increase in penalties for failure to file W2.

IRS claims that –

“the Note for Employers that was previously provided on the back of Copy D has been removed from the Forms W-2AS, W-2GU, and W-2VI to reduce the number of pages for printing purposes.”

Additionally, if there are 250 or more returns, one needs to file the form electronically. Apart from that, there is disaster tax relief information.

How Can Someone File A W2 Form?

According to IRS.gov,

“Every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or Medicare tax was withheld) for services performed by an employee must file a Form W-2 for each employee (even if the employee is related to the employer).”

These employees are the ones from whom:

- Different taxes (income, social security, and Medicare) are liable for deduction from their gross pay.

- The employee can withhold Income tax if he claims no more than one withholding allowance. Also, this is true for employees who had not claimed an exception from withholding Form W4, which is an Employee’s Withholding Allowance Certificate.

Also, The employer must send an applicable employee with this form by 31st January every year so that the employee gets a good amount of time to file the income tax before the tax deadline. However, the tax deadline, in most cases, is 15th April.

Furthermore, once someone is filing the W2 Form, it is also important to include the W3 Form with it as well. The W3 Form is called the Transmittal of Wage and Tax Statements. This form contains the summary of all the W2 Forms for a particular employer and also contains the wages that the employer paid and the taxes the employer deducted from the employee.

How To Get Your W2 Form?

According to the information available to Investopedia,

“Your employer is required to provide you with copies of your W-2 each year if you are eligible to receive one. The deadline for companies to provide this form is typically by the end of January or early February following the tax year that just ended.”

You can get Form W2 both ways – by email or as a hard copy. The form is also available in electronic form (like PDF), which you can print out and fill up. The employer is responsible for sending out Form W2 to the employees. Employees also can receive the form from the payroll provider as well.

In Case You Lose Your W2 Form

According to the New York State Department of Taxation and Finance

“The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.”

However, if you have lost your W2 Form, you can do the following:

- Inform your employer immediately.

- contact the SSA (Social Security Administration)

- visit the IRS website, and get the “Transcript or Copy of Form W-2.” You can get guidance regarding such on the IRS official website.

Wrapping Up

Hope this article was helpful for you in getting a better understanding of the changes that happened in 2023 related to the W2 Form. How do you think the IRS can improve this form for better tax filing? Also, share your thoughts regarding the matter in the comments section below.

Continue Reading:

Leave A Comment