The Form W2 is an extremely important document that shows your information about your total filing of taxes in the last year. It basically gives you an idea and proof of your previous year’s filing. However, if you changed your job last year, you must still have a full record of your tax filing throughout the year. This article is about how to get W2 from a previous employer.

The first part of this article shall be about why someone would request a W2 Form from a previous employer. In the next part, we will provide you with the steps that you need to follow if you want to get the W2 Form from your previous employer. Hence, to find out in detail, read on through to the end of the article.

What Is The W2 Form, And Why Is It Important?

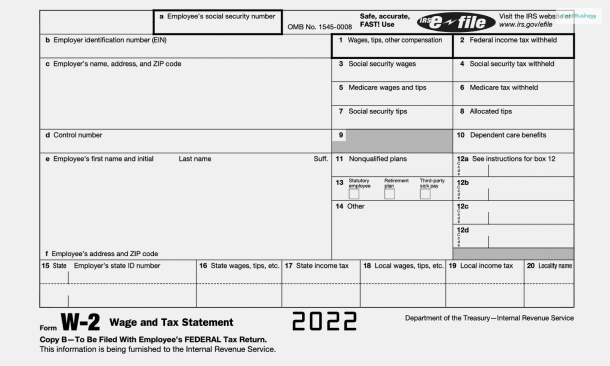

Basically, W2 Form (also called the Wage and Tax Statement) is an extremely important document that plays an essential role in your professional life. It gives you a detail of all the taxes paid to the government by the employer on your behalf. You will also get details of all the deductions from your annual income related to allowance, Medicare, and more.

According to Forbes,

“Employers are required to send matching copies of this document to each of their employees and to the Social Security Administration (SSA) at the end of every tax year. As an employee, you’ll use this form to prepare your tax return. If you’ve worked multiple jobs during the year, you’ll enter each W-2 form separately.”

Hence, this shows that you must receive the W2 by the end of the year.

The amount of taxes that are withheld from your paychecks throughout the year helps in reducing your total tax liability. The best part is that if the total amount of taxes that are withheld from you by your organization is greater than the total amount required, you can get a tax refund. In other cases, you can also get tax relief if your tax withholdings are great than the amount required.

Furthermore, the opposite case is true as well. If your employer has not withheld enough amount of taxes from you, then you are liable to do the tax returns to the IRS (Internal Revenue Service). Basically, the IRS does a cross-checking to ensure that employees and employers report every tax return. If the amount reported through the W2 Form does not match the required sum, the IRS can delay your return.

Why Do You Need To Get Form W2 From Your Previous Employer?

According to ThePaystubs.com,

“People who change jobs more often become very good at internal consulting skills and at branding themselves. But before you get too excited about the new skills you will learn and new people you will meet at your new job, you can’t forget about one important thing – your W-2.”

As per the mentioned rules of the IRS, you must receive the W2 by the end of the year. However, if you left your previous organization during the middle of last year, you might not have received the W2 for the months you have worked for that company. In such cases, you will need to ask for the W2 from your previous employing company.

Here, the Forbes Advisor recommends –

“Employers must file Form W-2 and provide employees with copies. Employers must provide W-2s to their workers no later than Jan. 31 each year, either by mail or electronically. The deadline should leave you plenty of time to file your return by the annual tax deadline, which is typically April 15.”

Hence, if you do not get a copy of Form W2 in the given window, the responsibility is with you to ensure that you get a copy of the form and file your tax returns within the given time.

How To Get W2 From Previous Employer? – Steps To Follow

By the end of January, your former employer must mail you a copy of the W2 Form. If you have not received the copy, if the form has not yet arrived to you because of delay, or if you have somehow misplaced the form, you will need to take some immediate action. If you do not take action fast, you might have to pay some tax-filing penalties.

For exceptional cases, the Forbes Advisor recommends –

“If your employer is unable to help you, then you can request your wage and income transcript from the IRS. You can request a copy of your transcript by using the IRS Get Transcript tool or calling 800-908-9946. Requesting a copy online will be faster than receiving one by mail.”

The following are the major steps that you can take to receive the Form W2 from your previous employer:

1. If you have applied to receive only paperless statements from your former employer, then you must check your email carefully. Search your inbox. If you do not find there, check your spam folder. The mail contains a link to the official IRS site, where you can access the form and download it.

2. If the company forgot to send you the form, try to contact them, especially the HR department. If they have mailed the form, and it is somehow lost, ask them to resend the mail.

3. If your previous company used a third-party payroll, consider contacting that payroll administration. Confirm whether they have sent you to the right address or not.

4. As explained before, you can contact the IRS directly through the phone if you have not received the form by 14th February. Here, you will need to share your previous employment details, including the last EIN (Employer Identification Number).

Bottom Line

How to get W2 from previous employer? – To get your W2 form from your previous employer, follow the steps that are mentioned in the prior sections. Hope this article was helpful for you in getting a better understanding of the W2 Form as well, which is your annual Wage and Tax Statement. Do you really think the W2 Form is useful? Consider suggesting some upgrades in the form in the coming years in the comments section below.

Continue Reading:

Leave A Comment