In the dynamic landscape of business, every decision you make carries the potential to shape the future of your organization. As you aspire to steer your company towards growth and success, navigating the financial terrain becomes paramount.

As a business leader, you understand the significance of making sound financial decisions. Whether you’re just beginning or an established enterprise, the growth path requires a strategic approach to managing your financial resources. This approach is especially relevant in today’s landscape, where businesses are experiencing financial challenges due to regulatory demands.

In a recent study by the U.S. Chamber of Commerce, it was revealed that 87% of U.S. businesses experienced adverse impacts due to regulatory-related cost increases. This highlights the pressing need to observe the current regulatory landscape and devise ways to navigate it.

This blog aims to offer four invaluable financial tips that can empower your organization on its journey to expansion.

Optimize Budget Allocation For Growth

In today’s dynamic business landscape, effective budget allocation is a cornerstone for organizational growth. It’s not merely about having a budget but about strategically optimizing it to drive expansion. To meet this imperative, you must assess each expense, ensuring it aligns directly with your growth objectives.

Amidst the financial challenges that businesses face, a Gartner survey sheds light on a critical aspect. According to the survey, about 71% of CMOs feel the burden of insufficient budget in fully executing their marketing strategies in 2023. This indicates the common struggle many organizations encounter, underscoring the need for a comprehensive approach to budget allocation.

So, where does the key lie? It lies in scrutinizing your budget with a growth-oriented lens. Identify areas where funds can be reallocated to initiatives that directly contribute to your expansion goals. By streamlining your budget in this manner, you position your organization to overcome financial hurdles and pave the way for robust, sustainable growth.

Leverage Technology For Financial Efficiency

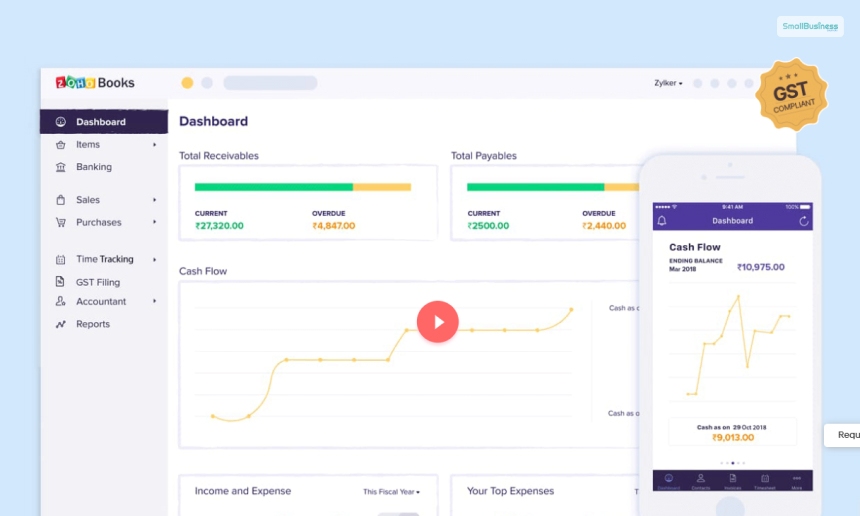

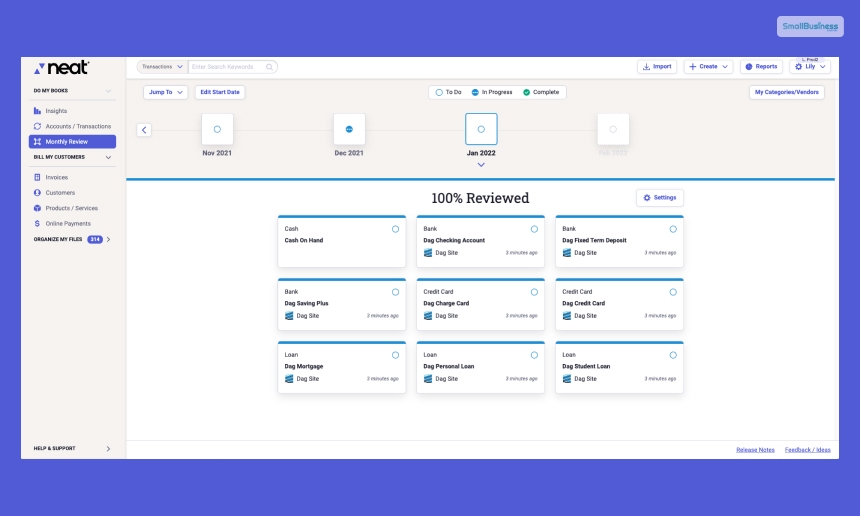

Harnessing technology is paramount for boosting financial efficiency in the growth journey of your organization. Embrace digital tools and systems that streamline financial processes, automating routine tasks for a more agile and error-free operation. These technologies enable quick decision-making and provide real-time insights.

When integrating technology, consider adopting cloud-based accounting platforms for increased accessibility. Cloud solutions strengthen data security and facilitate remote access, empowering your team to stay connected and make informed decisions wherever they are.

Financial leaders are leveraging the potential of AI to bring benefits to their organizations. As per a recent survey conducted by KPMG, leaders express optimism regarding the advantages of AI.

Specifically, 51% anticipate increased efficiency and decreased staff burden, while 50% foresee more accurate and reliable data. Plus, 48% believe AI will enhance the ability to identify outliers, and 27% view it as a solution to address staff shortages.

For higher efficiency, project management accounting software emerges as a game-changer. Such software enables accurate tracking of project costs. By incorporating these tools, you increase your organization’s ability to manage multiple projects simultaneously.

As per Mango Practice Management, this software incorporates advanced elements such as a detailed project dashboard, customizable project templates, automated email notifications, etc. The integration of these features improves user experience and facilitates seamless project management within the system.

Enhance Financial Planning And Analysis

Revamp your financial planning and analysis for strategic growth. Active involvement in planning and analysis ensures a dynamic approach to decision-making.

In a recent survey gauging CFOs and finance leaders’ priorities, financial planning and analysis emerged as a top concern. Rated on a 10-point scale, with “1” reflecting the lowest priority and “10” the highest, financial planning and analysis received 7 in 2023. This underscores its significance in steering organizational success.

To streamline financial planning, leverage technology for real-time data analysis and forecasting. Ensure that your financial team has the tools to act upon insights. By elevating your planning and analysis capabilities, you equip your organization to navigate uncertainties and make informed decisions that propel growth.

Diversify Revenue Streams Effectively

In the pursuit of business growth, effective revenue diversification is paramount. Analyze your current revenue streams and identify opportunities to expand into new markets or offer complementary services. This proactive approach allows your organization to tap into untapped potential and mitigate the risks associated with relying on a single income source.

According to a recent McKinsey research involving over 1,000 business leaders, there’s a notable shift in revenue expectations. On average, executives anticipate that 50% of their revenues will be derived from new products, services, or businesses in the next five years. The finding emphasizes the importance of strategically diversifying revenue streams to align with market trends.

When diversifying revenue, consider leveraging existing strengths and expertise while exploring innovative partnerships. By effectively diversifying your revenue streams, you position your organization to adapt to market changes and ensure a resilient and thriving future.

Prioritize Debt Reduction Strategies

In the pursuit of sustained growth, prioritizing debt reduction is a fundamental financial strategy. Evaluate your current debt obligations, categorizing them based on interest rates and terms. Actively managing debt allows you to allocate resources more efficiently, directing funds toward expansion initiatives.

Identify high-interest debts and strategize repayment plans to minimize financial strain. Proactively engaging with creditors and renegotiating terms can create opportunities for more favorable conditions. By adopting an assertive approach to debt reduction, your organization can free up resources for investment in growth-oriented activities.

Consider implementing a debt snowball or avalanche method, focusing on clearing smaller debts first or tackling high-interest debts strategically. This targeted approach not only reduces financial stress but also positions your organization for long-term health. Prioritizing debt reduction is a proactive step toward building a robust foundation for the future growth of your business.

In conclusion, navigating the financial landscape is integral to propelling your organization toward growth. By prioritizing the strategies discussed, you can lay a solid foundation for success. These practical tips empower you to make informed decisions, adapt to challenges, and foster a resilient future for your growing business.

Continue Reading:

Leave A Comment