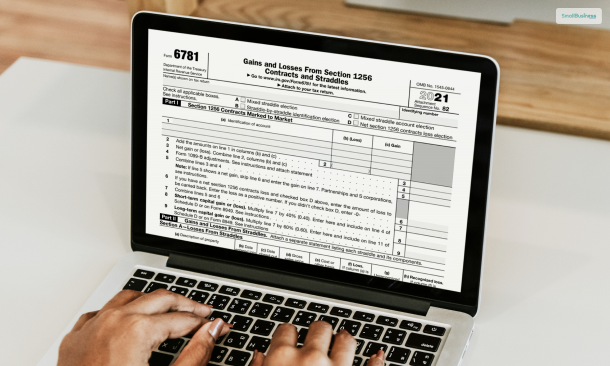

IRS Form 6781 shows the tax details about the gains and losses from Section 1256 Contracts and Straddles. The Section 1256 Contracts are mostly financial contracts. While on the other hand, a straddle is a strategy to hold contracts that help offset the risks of losses. Section 1256 basically explains how to report taxes for certain investments (including futures and options).

In this article, you will learn the details of the IRS Tax Form 6781 and what are its constituents. Apart from that, you will also know what are Section 1256 investments and straddles. Finally, we will discuss how to use Form 6781 to report taxes. You will also know who can file Form 6781. Hence, to learn about this IRS form, read on through to the end of the article.

What Is The IRS Form 6781?

According to Investopedia,

“Form 6781: Gains and Losses From Section 1256 Contracts and Straddles is used to report gains and losses from straddles or financial contracts that are labeled as Section 1256 contracts. A straddle is a strategy that involves holding contracts that offset the risk of loss from each other.”

As per the IRS Form 6781 Instructions, most traders of options and futures must use this form while completing their taxes at the end of the financial year. For reported investments, the short-term gain or loss should be reported at 40%, while the long-term gain or loss should be reported at 60%.

What Does Section 1256 Include?

Section 1256 of the IRS talks about certain types of investments in contracts and straddles. These investments include:

- Regulated futures contracts

- Dealer securities futures contracts

- Foreign currency contracts

- Non-equity options

- Dealer equity options.

According to Intuit TurboTax,

“If you buy both a call option and a put option for the same investment security at the same time, your investment is known as a straddle. With a straddle, you typically only make money when there’s a significant price change in the underlying investment.”

One of the major characteristics of Section 1256 investments is that the investor makes use of the leverage option. It means that the investor only puts up a small amount of money, and with that money, he controls an investment of larger value.

To provide you with an example, consider an investor investing in a futures contract. Here, the investor has the capability to control $100K of a particular commodity with a deposit of only $5K. This deposit is called a margin deposit. Hence, these investments fall under Section 1256 since they consist of high gains and losses.

Reporting Gains And Losses On Section 1256

In general situations, suppose you buy a stock for $100 per share. If you hold the stock for ten years, you will not need to report any gains or losses on the stock unless you sell the stock. However, according to IRS Section 1256, you will need to report actual or would-be gains as well as losses on investments through the end of the year. You have to report them on Form 6781.

The following are some of the things that you will need to know about Section 1256 Investments:

- By the end of 31st December every year, you will need to report your gains and losses. These gains or losses must be based on the actual sale of the stock or the fair market value.

- Even if you keep the investments on Section 1256 financial contracts and straddles, you will still need to complete Form 6781.

- You will need to ensure “mark to market.” This is the process through which you assign fair market value to investments that you continue to hold but not sell.

- As already explained, every long-term gain or loss is reported at 60%, while every short-term gain or loss is reported at 40%.

(Here, long-term gains are for those investments that the investor held on to more than one year. On the other hand, short-term gains are for those investments which are held for less than one year. Actually, long-term gains have more advantageous tax characteristics than short-term gains.)

Who Can Use The IRS Form 6781?

According to the rules of “mark-to-market,” individual tax filers must report their gains and losses through Section 1256 investments.

According to Investopedia,

“Section 1256 contracts include regulated futures contracts, foreign currency contracts, options, dealer equity options, or dealer securities futures contracts. These investments are considered to be sold at year-end (even if the positions are not actually closed) for tax purposes. They are assigned their fair market value in order to determine gains and losses.”

Once you go through the IRS Form 6781, you will find separate sections for Section 1256 contracts and straddles. Hence, you will be responsible for identifying the type of investment that you used. We recommend you take the help of a tax professional while filling out Form 6781 to report Section 1256 gains and losses.

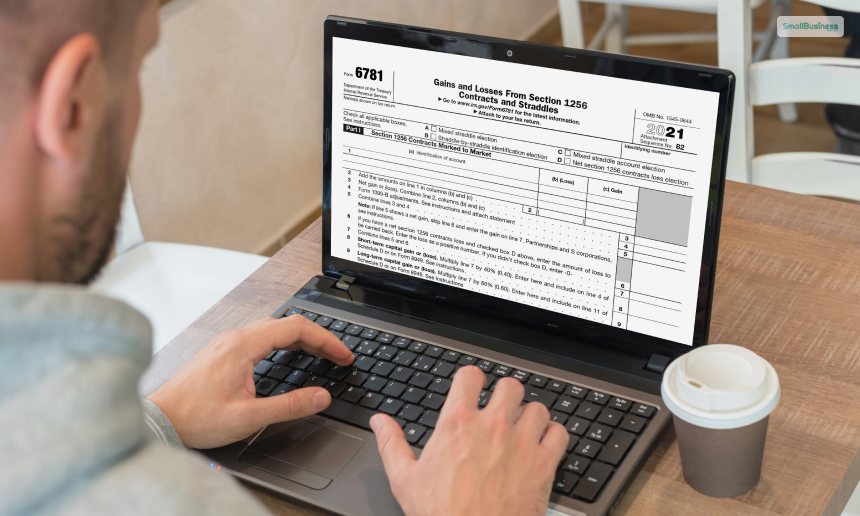

How To Use Form 6781 To File Gains And Losses From Section 1256?

There are three parts of the IRS Form 6781, which need to be filled out separately:

Part 1

Here, you will need to report Section 1256 gains and losses at either the actual selling price of the investments or the mark-to-mark price (as of 31st December).

Part 2

Section A: Losses on the trader’s straddles.

Section B: Gains on the trader’s straddles.

Part 3

Here, you will need to fill out any unrecognized gains on positions that you held at the end of the financial year. This is also true for loss in a recognized position.

Wrapping Up

The IRS Form 6781: Gains and Losses From Section 1256 Contracts and Straddles is distributed by the Internal Revenue Service through the Internet, as well as physically. Investors use this form to report their gains and losses from financial contracts and straddles.

Inside the IRS Form 6781, there are separate sections for Section 1256 financial contracts and straddles, where you can report your gains and losses accordingly. However, we always recommend taking the help of a tax professional. Do you have any further ideas on how to fill out Form 6781? Share your ideas with us in the comments section below.

Continue Reading:

Leave A Comment