As a result of financial struggles or unforeseen economic circumstances, it’s possible to find oneself in a situation where debts seem insurmountable.

In these situations, the creditor may decide to settle the debt for a reduced amount or, in some cases, write it off entirely. While this could appear as a financial relief on the surface, it’s essential to understand that these actions could have significant tax implications.

This article aims to shed light on the tax consequences of debt settlement or write-off and offer tips on what to do next.

1. Understand That Forgiven Debt May Be Taxable Income

The first point, recommended by Tax Law Advocates, is the understanding that forgiven debt may be considered taxable income by the IRS. When a creditor forgives a debt, they often report it to the IRS using a 1099-C form, indicating that they have “income” from the cancellation of the debt.

According to the IRS, there are a few exceptions where forgiven debt isn’t considered taxable, such as bankruptcy, insolvency, or some student loan situations. It’s crucial to consult a tax professional to understand your specific situation better.

2. Consult A Tax Professional Early

When you’re in the process of negotiating a debt settlement or after a debt has been written off, it’s advisable to consult a tax professional.

They can help you navigate the tax consequences and possibly mitigate the impact on your income taxes. This step is critical because the additional income from debt forgiveness could push you into a higher tax bracket, resulting in you owing more in taxes than expected.

3. Check For Errors On Form 1099-C

If a creditor writes off or settles a debt, they will likely send you a Form 1099-C, Cancellation of Debt. This form shows the amount of debt canceled and other information. It’s important to review this form carefully for any errors. If there’s an error, contact the creditor immediately to correct it. Otherwise, you may end up paying taxes on more canceled debt than you should.

4. Insolvency Exception

The IRS has an insolvency exception, meaning if you were insolvent immediately before the cancellation of debt, you might not be subject to tax on the forgiven amount. Insolvency means your total debts exceed the fair market value of your total assets.

Keep in mind that determining insolvency can be complex and should ideally be done with the assistance of a tax professional.

5. Explore Filing For Bankruptcy

If the tax consequences of debt settlement or forgiveness seem overwhelming, it may be worth considering filing for bankruptcy. If you file for bankruptcy, and a debt is discharged as part of the bankruptcy proceedings, the canceled debt isn’t considered taxable income.

This move should be carefully considered and only taken as a last resort, under professional advice, as bankruptcy has its own severe financial consequences.

6. Plan Your Future Financial Strategies

Once you’ve navigated through the tax consequences of a written-off or settled debt, it’s time to plan your future financial strategies. It might be beneficial to meet with a financial advisor to understand how to better manage your income and expenses, build an emergency fund, and possibly invest wisely to ensure you don’t find yourself in similar debt situations in the future.

7. Settling A Debt For Less Than Owed

In some cases, you may negotiate a settlement with your creditor to pay less than the full amount owed.

While this may alleviate your financial burden, it can still have tax consequences. The difference between the settled amount and the original debt is considered taxable income, similar to a debt write-off. You should anticipate receiving a Form 1099-C and consult with a tax professional to understand your reporting obligations.

Ask if Your Small Business Needs a Debt Settlement!

Yes, taking debt settlements by negotiating with your creditor has some good implications. Well, the situation for every business and individual will be different. However, if you are wondering whether it’s a good idea to take debt settlement or not, check the following things –

- First, review your financial situation. Write down the amount you owe and the creditors you owe to; not all debts are of the same type, so make sure to outline those, too.

- Go through your monthly budget and your income. Calculate the amount you can set aside for debt repayment. When you know your operations, payrolls, and additional business expenses, you can read the amount you can use for debt repayment.

- Contact your creditor for debt settlement. It’s best to have a hard number ready to give your creditor a clear picture. But, it’s best to always start with a low amount. It’s great if your creditor agrees to your amounts and terms of settlement. But, even if you get time for a lump sum repayment (with slight adjustments to the debts), that might also be a good option to consider.

However, the entire debt settlement decision depends on the state Your business is in.

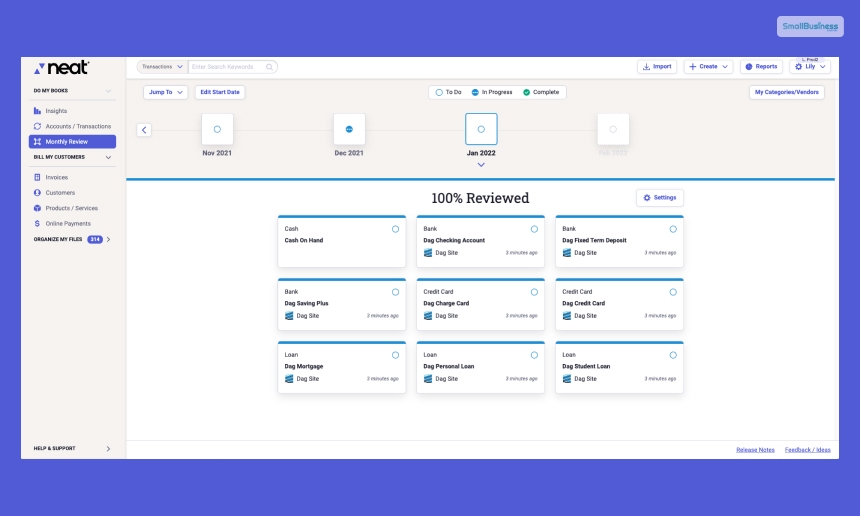

Debt Settlement for Small Business Owners

There are several ways someone can achieve or get their debts settled. How does debt settlement work for small business owners? It’s not impossible to ask your creditor to lower the amount of debt you owe them.

As a debtor, your goal should be to ask for a lump sum of money in discounts. Businesses going through financial distress can achieve massive relief through a debt settlement.

So, here’s how it works –

Negotiate with Creditors

The first technique is to come to terms with your creditor and talk about negotiating the amount you owe. It’s best to request for an exact number or percentage of the amount owed to be written off.

Many creditors often prefer not to default on the entire amount owed. So, they may even consider reducing the amount owed.

Lump Sum Payment

If your creditor agrees to your proposal, you’ll have to repay the debt as per the resettled terms. This payment usually is a percentage of what you owe to your creditor. Typically, the number ranges between 30% to 70%. So, once you have come to terms, make sure you pay the amount as soon as possible.

Suspension Payments

When settling debts, you will typically stop making your monthly payments to the creditors on a regular basis. This is the time to save the repayment amounts so that you can save it in lump-sum. So, without spending the money elsewhere, use this period to ready your cash reserve for complete repayment.

Implement on Credit

When you settle your debts with your creditors, it has some effects on your credit scores. It is something that’s considered a type of debt restructuring. Yes, there will be an impact on the credit score which is only temporary. Compared to this, the long-term benefits you will have with the debt settlement will eventually help your credit score.

In Conclusion

Dealing with the write-off or settlement of debt can be a daunting task. However, understanding the potential tax implications is critical. Keep in mind that everyone’s financial situation is different, and the advice of professionals like tax advocates, accountants, and financial advisors can be invaluable in helping you navigate the process.

Read Also:

Leave A Comment