Small Business Grants are free funding for small businesses. However, to qualify for a grant, a small business needs to fulfill certain requirements. You can secure a grant as an owner of a small business or even if you are starting a business. But, to secure a grant, you need to approach the right grant provider. The US federal government, state governments, and even corporate giants have programs that offer grants to small businesses.

In this article, you will learn about small business grants in general and how they work. Furthermore, you will also learn about the major types of small business grants. Next up, this article shows you the difference between a grant and a loan. Then, this article will guide you on how to apply for small business grants and how to qualify for one. Finally, you will learn about the major pros and cons of such grants.

What Are Small Business Grants?

According to Investopedia,

“A small-business grant is an award, usually financial, given by one entity (typically a company, foundation, or government) to a company to facilitate a goal or incentivize performance. Grants are essentially gifts that usually do not have to be paid back. Small-business grants are targeted to a variety of purposes, from starting a company or helping it run more efficiently to aiding its expansion.”

Hence, you can see that business grants are gifts to small businesses. However, these gifts also come at certain costs, as they are not simply free money. The business that gets a grant needs to qualify for the grant and act in accordance with the terms of the grant. If the business fails to follow the terms of the grant, it might need to pay back the grant with interest.

However, if the business follows the terms of the grant, it does not need to pay back the grant to the provider. Despite that, since grants are a type of income that a business receives, they are subject to taxation.

In general, a business grant lifecycle consists of three stages – pre-award, award, and post-award. This is because all these stages consist of different functions. You can learn about the stages later in the article. The major providers of business grants are the federal government, the state government, and other corporate organizations.

Despite some of the major benefits of business grants, one of the major disadvantages of grants is that they are difficult to obtain. Basically, grants are competitive, and a business needs to fulfill various requirements to secure a grant from an organization. You will learn about the major qualifications of grants later in the article.

How Do Small Business Grants Work?

BankRate.com states –

“Small business grants are one of the most attractive financing options for business owners since they don’t need to be repaid and don’t require companies to take on debt. But grant programs tend to be highly competitive, with many of them targeted at underserved groups.”

Government and private organizations offer business grants for specific purposes. Hence, the application process for small business grants is really time-consuming. Here, the business owner has to go through various screening processes. Apart from that, the business also needs to offer information about its structure and plan.

The application process for small business grants is called the “grant lifecycle.” This lifecycle has three phases in it – pre-award, award, and post-award.

During the pre-award phase, the awarding agency decides on the fund and its purpose. Then, it announces the business grant and starts accepting applications to review them.

Then comes the award phase, where the granting agency informs applicants whether they are approved for the business grant or not. After that, the grantor starts working with the grantee to finalize the legal framework for the business grant. Then, it disburses the fund.

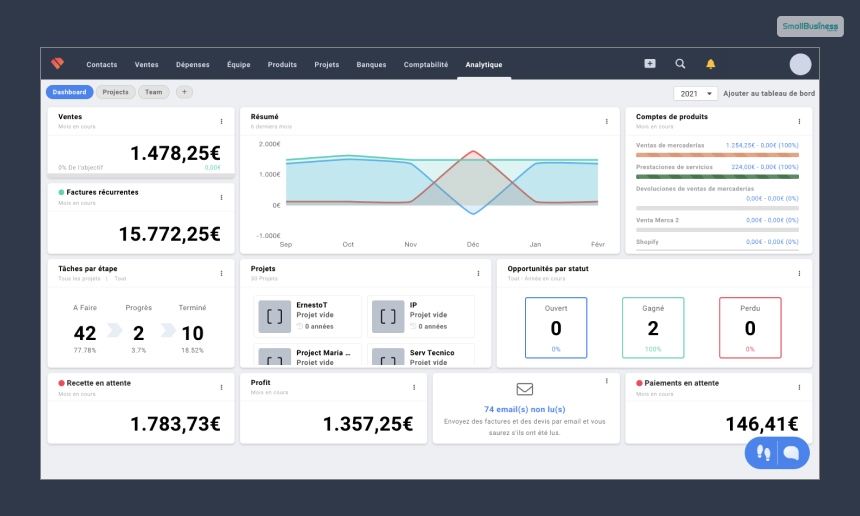

Finally comes the post-award phase. Here, a guarantor assigns a grant management officer or a team to oversee the compliance of the business grant during its lifetime. The grantee submits regular reports to the manager and on-site audits. This is when grant management tools become particularly useful, aiding in compliance tracking, report submission, and audit management. With time, the grantor closes out the business grant once it evaluates that the grantee achieved the terms of the goal.

What Are The Types Of Small Business Grants?

The major types of small business grants depend upon the agency that is sponsoring it. The top three major sources that offer business grants are the federal government, state and local governments, and some corporations.

1. Federal Small Business Grants

These grants are provided by the US Government through various agencies and departments. You can learn more about federal grants on the “Grants.gov” website.

2. State And Local Government Grants

Various state and local governments provide grants to their resident businesses. They draw these grants from federal funding as well as their own resources. To learn about the major grant provider agencies in your state, check your state government’s website. You can also type the name of your state on Google, followed by the phrase “small business grants.”

3. Corporate Small Business Grants

Some corporations and non-profit organizations also offer grants to small businesses. Apart from just money, these organizations also offer mentorship programs to the winners of their business grant programs. To start looking for corporate and non-profit grants, check the SBA website or visit your nearest SBA center.

How Do Small Business Grants Differ From Loans?

The major difference between a business grant and a loan is that you have to pay back the latter to the provider. In general, a grant is a gift, and you will not need to pay it back. The providers of grants are governments, corporations, and trusts. On the other hand, banks and private lenders generally offer loans to businesses and individuals.

In a loan, there is a formal agreement (loan agreement) that ensures both parties receive the protection. It means that a family member or a friend repays it. Basically, the borrower of the loan will need to pay it back with interest and also within a certain period of time. Furthermore, if the borrower fails to repay the loan, the lender has the right to take the borrower’s asset in case of collateral.

However, grants, on the other hand, also have some terms and conditions. Businesses need to qualify for grants, and the process is lengthy and difficult. Even when an opportunity for a grant arises, it is still difficult to secure one. But, securing a loan is not that difficult since the business/ individual agrees to back the loan, along with interest. Hence, businesses typically rely on loans to obtain the funds that they need.

How To Apply For Small Business Grants?

If you want to apply for small business grants, you will need to learn whether you qualify for the grant or not. There are different criteria for small business grants that you will have to take into account. Hence, learning about the qualifications as well as the application process will help you a lot.

Qualifying For Small Business Grants

You have already learned that securing small business grants can be extremely competitive. Furthermore, you need to be a certain type of business owner or own a certain type of business to secure a business grant. Hence, if you want to qualify for a business grant, you have to narrow down your list of grants that are good matches for your business.

Once you do that, you will need to carefully look at your application process for each grant program. Here, you will need to spend enough time to fill out the applications thoroughly. Also, you must make sure that you supply documents and backups that are required in the application. As there are several applications for each business grant, you do not want to lose out because of technical issues.

Look for past winners of a program, and you will have a better idea of what the grantor is expecting from the grantee. Search for past winners on the grant websites. This way, you can learn more about how you can position your business to receive a particular business grant.

Application For Small Business Grants

You will need to check for any deadline for a particular business grant. This will give you an idea of the time of the application.

According to Investopedia,

“Some programs accept applications throughout the year, while others may have annual or quarterly deadlines. While you shouldn’t rush yourself in filling out your applications, it is in your best interest to get them in as early as possible. Most grant programs have a limited amount of funds and may stop even reviewing applications once the money is exhausted.”

You need to be extra careful while you are applying for grants. How you write your grant application will decide a lot about whether you will receive the application or not. Hence, writing business grant applications has become a craft in itself. Even writing business grant applications has become a full-time profession for many people.

However, if you are applying for a business grant for the first time, you can check a lot of useful information online and in books. You can check the Grants.gov website to get useful information on how to fill out a business grant application.

What Are The Major Pros And Cons?

Pros Of Small Business Grants

According to American Express,

“The main advantage of using small business grants is that you do not need to repay them. This is welcome news for many small businesses that may have financing difficulties that make it challenging for them to repay a traditional business loan. Another pro is that information about the availability of small business grants is relatively easy to find online.”

1. Small business grants are essentially free money, and you will not need to repay.

2. The amounts you get through business grants are high, and the better the idea, the higher the amount.

3. You will have access to a lot of information, especially about how to receive the grant.

4. Once you receive a grant, you will also be eligible to receive many others as well (waterfall effect).

5. Receiving a business grant will increase your reliability and credibility as a business. As a result, it will also help in promoting your business idea.

Cons Of Small Business Grants

Here are a few cons of small business grants that you need to be aware of:

1. The application process is really time-consuming. Furthermore, it is also difficult to find one that works best for you.

2. Since you receive it as a form of income, they are subject to taxation too. Hence, small business grants are taxable income.

3. Since there are a lot of businesses that want to receive the money, there is huge competition for one grant.

4. There are situations where you will not be able to renew the business grant that you applied for. Hence, you will stop receiving the money altogether. In other cases, you might have to reapply for grants for years to receive a reply.

5. Although business grants are free money, they come with a variety of restrictions and conditions. Once you receive the grant, you will have to stick to its terms and conditions. If you don’t do so, it will be regarded as a loan, and you will have to repay it with interest.

Wrapping Up

Hope this article was helpful for you in understanding how small business grants work in general. You have also learned how to apply for a small business grant and how does the application process works.

However, before you consider applying for a grant, make sure to go through the major pros and cons of business grants in the last section. Do you have further information to add about how to secure a small business grant? Consider sharing your ideas and opinions in the comments section below.

Continue Reading:

- The Best Short Term Loans For Businesses In 2024

- Top Online Accounting Firms For Small Business In 2024

- How Contractor Mortgage Brokers Support Homeownership Goals

odpri racun na binance

1 July, 2024

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?