In today’s fast-paced world, where financial stability is a key concern for many individuals, the search for effective ways to grow one’s savings has become increasingly vital. Among the various options available, high-interest savings accounts have emerged as a popular and attractive choice. In this article, we will delve into the reasons behind the rising appeal of high-interest savings accounts and how they can pave the way for financial success.

The Basics Of High-Interest Savings Accounts:

High-interest savings accounts are a type of savings account offered by banks and financial institutions with a distinct advantage – they provide a higher interest rate compared to traditional savings accounts. While the specific interest rates may vary, these accounts generally offer more substantial returns on your money, making them an appealing choice for those looking to maximize their savings.

Safety And Security:

One of the primary reasons individuals opt for high-interest savings accounts is the assurance of safety and security they provide. Unlike riskier investment options, such as stocks or mutual funds, high interest savings account offer a guaranteed return on your savings. This makes them an excellent choice for those who prioritize stability and want to shield their money from market volatility.

Liquidity And Accessibility:

Another attractive feature of high-interest savings accounts is their liquidity and accessibility. Unlike long-term investments that may tie up your funds for an extended period, these accounts allow you to access your money when needed. This flexibility is particularly beneficial for individuals who want their savings to be readily available for emergencies, major purchases, or unforeseen expenses.

Earning More With Compound Interest:

One of the key advantages that make high-interest savings accounts stand out is the power of compound interest. In simple terms, compound interest is the interest earned on both the initial principal and the accumulated interest from previous periods. This compounding effect can significantly boost your savings over time, creating a snowball effect that accelerates the growth of your money.

Read Also: Huntington Bank Review 2023: A Full-Service Bank Designed For Businesses

Peace Of Mind:

For many individuals, the psychological aspect of financial management is just as crucial as the numbers. High-interest savings accounts provide peace of mind by offering a secure and predictable way to grow savings. Knowing that your money is working for you and steadily increasing can alleviate financial stress and contribute to an overall sense of well-being.

Ideal For Short-Term Goals:

High-interest savings accounts are particularly well-suited for short-term financial goals. Whether you’re saving for a dream vacation, a down payment on a home, or an emergency fund, these accounts’ stable and predictable growth can help you reach your goals more efficiently. Their low-risk nature makes them an attractive option for those who don’t want to expose their savings to market fluctuations.

Shop Around For The Best Rates:

When considering a high-interest savings account, shopping around and comparing rates offered by different banks and financial institutions is essential. Interest rates can vary, and finding the best deal can significantly impact your overall returns. Online banks often offer competitive rates, so exploring options beyond traditional brick-and-mortar banks may lead to a more favorable outcome for your savings.

Considerations And Potential Drawbacks:

While high-interest savings accounts come with numerous benefits, it’s also essential to consider potential drawbacks. The interest rates offered may still be lower than the returns from riskier investment options.

Additionally, some accounts may have withdrawal restrictions or fees for exceeding a certain number of transactions. Awareness of these factors can help you make an informed decision aligning with your financial goals.

Reason To Open A High-Yield Savings Account

Here are some major reasons you must go for a high-yield account.

You Can Start Earning More Interest

One of the advantages that you have with a savings account is the high-yield savings account. Yes, you earn it significantly higher than the generic saving accounts. Let’s give numbers. The annual percentage rate or the APRs on the regular saving accounts hovers around 0.40%. However, the interest rate is significantly higher with the help of the high-yield savings account.

For instance, if you have around $5000 in your savings account, you will have to make $20 after one year. The same is true with the high-yield savings account, which will help you earn around $175 a year! Now you can imagine the rate of growth and the advantage you have with this kind of account.

Accounts Are Low Risk

Another benefit of the high-interest savings account is the lower risks. Yes, you may understand that the rates of change in the interest amount and also the earnings could experience a significant drop in the times to come. Again, the reverse may happen with the amount. But one thing is sure: your money will only grow.

This assurance that you get with this form of savings account is what you need. Not only this, but you can enjoy another feature: this account are FDIC insured. Hence, you do not have to live with the fear of losing the amount of money.

Easy To Open

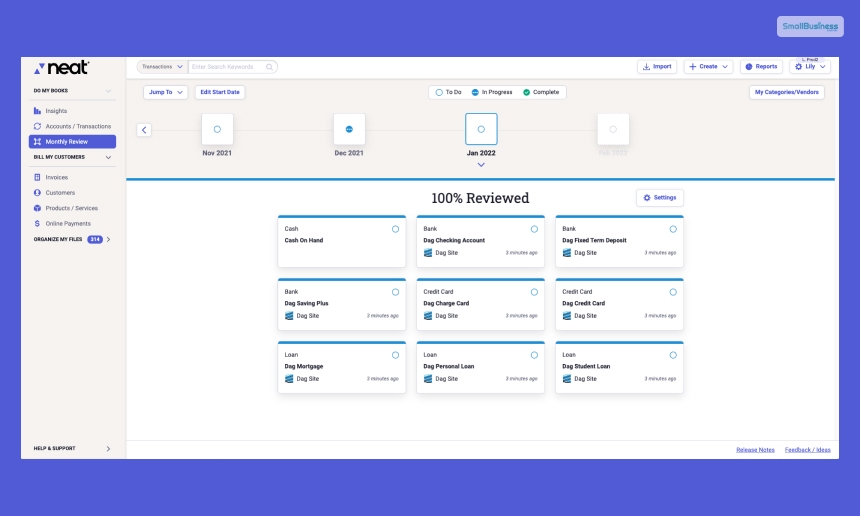

This is the age of digitization and online banking, and you can get the same benefits with this very type of account. You do not have to physically go to the bank and fill out the emergency paperwork.

With the online service that is online banks, you can easily create a savings bank account. Even the brick and mortar institutions can help you get started as an individual. Moreover, you will be able to oversee and monitor the performance of savings with the bank application directly from your phone.

Conclusion:

In the quest for financial stability and growth, high-interest savings accounts have emerged as a reliable and appealing option. Offering a combination of safety, accessibility, and the power of compound interest, these accounts provide individuals with a practical tool to achieve their short-term financial goals while maintaining peace of mind.

As with any financial decision, careful consideration and research are crucial to finding the best high-interest savings account that suits your individual needs and aspirations.

Read Also:

Leave A Comment