When you purchase something, a surcharge fee is an extra amount that is added to your final bill if you pay through a debit card, credit card, or check in place of cash. The extra amount that you pay is for the extra services from merchants, government regulatory costs, or increased product costs. The surcharge amount you pay can either be a fixed amount or a percentage of your original bill for purchase.

In this article, you will get some general details about what a surcharge is. After defining surcharge and learning why it changes, we will learn some of the major applications of this form of payment. Apart from that, we will also share an example to explain the surcharge with you. Hence, to learn more about surcharges, read on through to the end of the article.

Surcharge Meaning – What Is A Surcharge?

According to Investopedia,

“The term surcharge refers to an additional charge, fee, or tax that is added to the cost of a good or service beyond the initially quoted price. A surcharge is often added to an existing tax and is not included in the stated price of the good or service.”

The surcharge can be a fixed amount, or it can be a percentage of your bill. Mostly, surcharges are applied due to extra merchant costs, the government’s additional need for revenue, or to take the costs for increased pricing for commodities.

This extra charge that you pay can be applied to various products and services. You might have to pay this charge in various places, including travel, medical, telecommunications, and more. The enterprises and shops that collect surcharges subsequently return those charges to the concerned authorities or financial institutions.

Why Surcharge Is Charged?

According to Wall Street Mojo,

“Businesses often struggle with balancing the costs of providing services due to accepting payments via a payment platform. Sometimes there are gradual increases in the prices of products they offer or regulatory fees that the government imposes on respective industries.”

Hence, you can understand the logic behind charging a surcharge.

Merchants, to offset this additional and indirect costs, charge an extra fee or tax from customers. This payment that customers pay to merchants is called a surcharge. You have to understand here that this charge is an extra one that you will have to pay in addition to the original price of the products and services that you buy. The seller adds the surcharge at the point of sale during the registration process.

Who Uses surcharges?

The surcharge is a fee that many businesses and organizations of different types (the government as well) charge. These surcharges can also alter and change over time. Because they reflect a cost that the original price of a good or commodity isn’t able to cover.

Using a surcharge to service instead of making adjustments to its price can also help consider conditional changes in the value without raising prices inconsistently.

How Does A Surcharge Work?

The surcharge is not taxable since the retail price on the bill already includes it. It is the money you pay other than the tax. This amount appears as a separate line item on your cash receipt.

There are many entities that assess surcharges. This includes businesses, governments, service professionals, service providers, and more. For example, at times when the gas price increases, a cab driver can add a fuel surcharge of $1 for the passengers.

According to Investopedia,

“Some surcharges are simply baked into the nature of the business. For example, restaurants may intentionally not serve condiment packets, as their business model may try to reduce costs by not handing out additional resources for free.”

N.B.: The surcharge is not included in the cost of the service or the product. The entities asses the calculated fee upon the purchase of the item. The amount then appears in the contract or sales and purchase agreement (SPA).

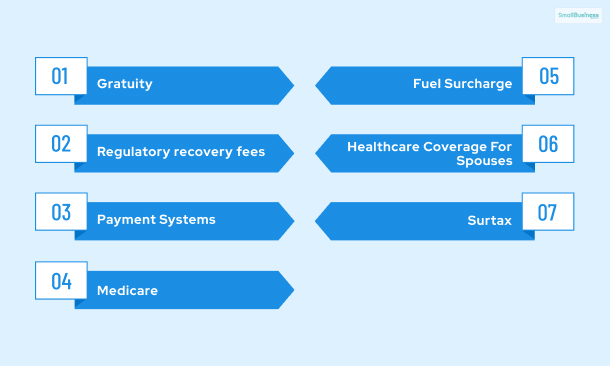

Different Applications Of Surcharge

As you already know, a surcharge can be there for a variety of cases. Here are some of the common applications of surcharge you need to know about:

1. Gratuity

There is a type of surcharge applied in restaurants. This is called gratuity and is used to compensate for the employment or labor cost. This type of surcharge helps the restaurant pay their employees fair wages without completely relying on the tips that the customers provide. The same goes for delivery companies, who compensate the drivers for their labor and for vehicle maintenance. These surcharges include additional fees like delivery, food coverage, and other operating costs.

The surcharge may also be included in the customer’s bill so they can review it and make full payment. A gratuity surcharge is usually a percentage of the total bill payable by the customers. For example, if the customer is paying $30 for their meal, the restaurant might charge them a gratuity of 15%, amounting to $4.50 extra on the customer’s bills.

2. Regulatory recovery fees

Recovery fees are also a type of surcharge and are usually seen on utility bills, internet and electric services, and cable services bills. Utility companies usually charge their customers with these bills to cover or offset the fees that the local, state, or federal government charges them. The regulatory fees are sometimes of specific amounts. Sometimes, the fees may take the form of a dollar amount or a percentage of the bill. However, usually, this type of surcharge is added like an extra dollar amount to the customers’ bill.

3. Payment Systems

If a customer pays after purchasing products from a retail shop, the cashier swipes the card of the customer. The POS system of the retail shop automatically charges an additional amount apart from the total payment. This is an example of a surcharge, and it can be up to 4% for a single transaction. However, it does not happen in every case.

4. Medicare

This is an additional fee that patients or their family members need to pay on top of the total amount of medical charges and taxes. However, this surcharge applies only if:

- Neither the patient nor their children or spouses do not have the essential healthcare coverage.

- The earning of the payer is beyond a specified limit.

5. Fuel Surcharge

This is the charge that carriers charge on basic shipping and freight rates. The carriers charge this payment to cover the costs of extra fuel since there is a continuous fluctuation of fuel prices.

6. Healthcare Coverage For Spouses

Employees who are covered under healthcare insurance from their employers might need to include their spouses under healthcare coverage. In this case, they will need to pay an additional surcharge for the coverage.

7. Surtax

Surtax is a tax that is imposed on top of another tax. This tax is created to fund certain government programs. However, surtaxes are more applicable to people with a higher income range.

Example Of A Surcharge – How To Calculate?

Suppose you buy groceries for $200, but the bill comes out to be $206. Once you ask the cashier for the extra $6 that you paid. She says that an additional 3% surcharge is in place for people using debit or credit cards to make payments.

Here is an explanation of the calculation:

[$200 + (3% of $200)] = [$200 + $6] = $206.

Bottom Line

Hope this article was helpful for you in getting an idea of what a surcharge is. It is the additional charge you have to pay while you purchase goods and services. This charge is separate from the price that you pay for your purchases. The price you pay can be fixed or a certain percentage of your purchases.

The additional amount that you pay applies to different areas, including payment processing, fuel consumption, Medicare, etc. Do you have further information to add related to this topic? Share your ideas and opinions with us in the comments section below.

Frequently Asked Questions

Here are some common questions people ask about surcharges. We have answered them for your ease of understanding –

1. What do you mean by Surcharge?

In short, a surcharge means an additional fee or an extra charge or tax that a company adds to the initial price of their good or service. It is usually added to the existing tax and mentioned in the product’s price, making the buyers pay a much higher price than the original price.

2. What Does Surcharge Payment Mean?

As a customer, when you pay a surcharge, you pay an additional fee when you choose to pay using a specific payment method. This payment method can be a business credit card payment for specific transactions. In some countries, surcharges are heavily regulated or prohibited completely.

Continue Reading:

Leave A Comment