The 1040 Form is also known as the United States Individual Income Tax Return Form. This form is provided by the Internal Revenue Service, and you must use it to report the standard federal income tax to the IRS. You can also claim tax deductions and credits through this form. Furthermore, you can calculate various tax refunds and tax bills for every year.

This article is about a general idea of the IRS 1040 Form. Firstly, you will know various aspects and the importance of this form. Then, you shall learn about the different types of this form that the IRS releases, along with their functions. Moreover, you will learn about the updated 2023 version of the form. Finally, we will share with you how to fill the form correctly for an income tax return.

What Is The IRS 1040 Form?

The IRS Form 1040 is the standard form that you can use to file your annual income tax returns as a taxpayer. Also, there are sections in the form where you will need to disclose your taxable income for the year. This will help in determining whether you owe additional taxes or whether you are eligible to get a tax refund from the IRS.

According to the Forbes Advisor,

“This is the standard form used by most people to file a personal income tax return, report the income they received during the year, and figure out how much of that income is taxable after claiming tax deductions and credits.”

Depending on the type of Form 1040, your filing may get simple or complicated. These depend on your type of income, your credits, as well as deductions.

The main purpose of this form is to declare how much tax is returned as compared to the annual income. Hence, if your income is over a certain limit, you will need to report that, including various tax deductions and tax credits for that very year.

Additionally, you can use this information further to calculate your annual tax liability for the given year, and you can find out whether you owe taxes to the state or whether you are eligible to get a refund.

What Is The Importance Of Filling The IRS 1040 Form?

According to Investopedia,

“Form 1040 is the central part of tax filing for United States citizens. It is the tax form that all taxpayer financial statements eventually feed into and supporting tax schedules branch out of. Regardless of an individual’s filing status or income, taxpayers who file taxes will complete some version of Form 1040.”

The importance of Form 1040 lies in a variety of factors. The first thing is that it confirms your identity, and thereby, it calculates your taxable income and finds out whether you have tax liability or not. Furthermore, the form also helps in finding out whether you have paid your tax bill or not.

Furthermore, regarding the taxable income, this form finds out your taxable income for a given financial year, in addition to the deductions that you would like to claim. A way to calculate this is to calculate your adjusted gross income (AGI) and subtract the allowable adjustments from it (if any).

According to Business Insider,

“When reporting your AGI, you can reduce how much you owe the IRS with standard deductions or itemized deductions. Subtracting your itemized or standard deductions from your AGI will calculate your taxable income. Itemized deductions include mortgage interest, charitable deductions, state and local taxes, and medical expenses — with certain limitations.”

The Various Types Of 1040 Form Available

Moreover, there are a variety of Form 1040 available, which you can use depending on your situation and the complexity of your income. Here are they:

- Form 1040-NR

- Form 1040-ES

- Form 1040-V

- Form 1040-X

- Form 1040-SR

2023 Updates On Standard Deductions

Every tax filing year, the IRS publishes a revised version of the form. Hence, in 2023, it came up with a new form.

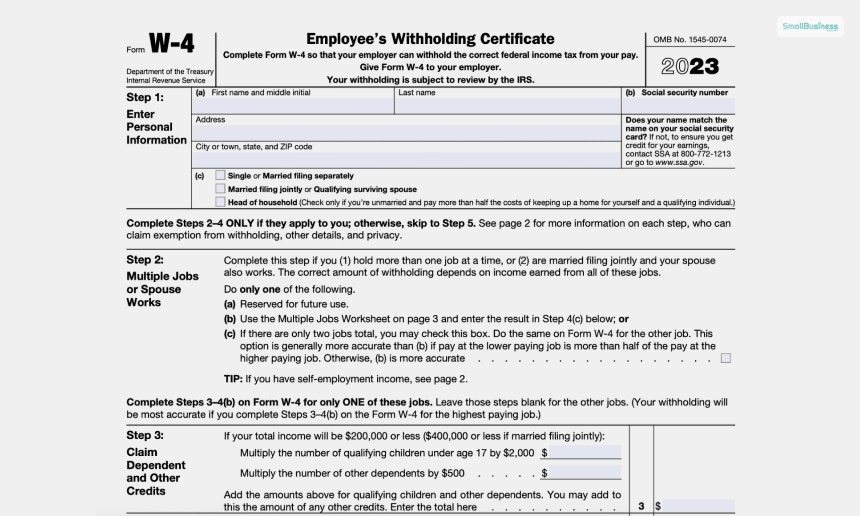

With time, this form has gotten simpler. According to various experts, if your taxes were relatively simple, you had the option to file Form 1040A or Form 1040EZ. However, in 2018, all these forms were eliminated for a singular Form 1040. This form is shortened, and there are fewer boxes that you need to fill or check.

The following are some of the major standard deductions on Form 1040 in the year 2023:

| Tax Filing Status | 2023 Updates |

| Single or Married (Filing Separately) | $13,850 |

| Married (Filing Jointly) or Qualifying Widow(er) | $27,700 |

| Head of the Household | $20,000 |

Furthermore, there is an additional deduction for individuals who are 65 years or older or blind. Such figures are annually adjusted for inflation (as of 2023):

- Single and not widowed: $1,850

- Married (filing jointly): $1,500 for each spouse who is 65 years old or blind.

How To Fill An Income Tax Return Through The 1040 Form?

There are two ways you can file your income tax return using this form – through the tax software or physically filling the form by downloading the PDF.

In the first case (through the tax software), you will need to provide information, and the information will be translated into entries in this form. Therefore, as per your responses, the tax program will auto-populate the spaces inside the form. You can also e-file the form with IRS. You can download a copy of the filled-up form for your records. In the second case, you can just fill it up on your own.

Bottom Line

If you are an individual taxpayer, you will need Form 1040 to file your taxes with the IRS. The form also helps in finding out whether additional taxes are due or if the tax filer will get a refund. While filling out the form, you will need to include your personal information, earning information, and profit, as well as your dependents.

Hence, depending on your situation, you will need to file supplemental tax 1040 forms as well. Do you have any recommendations regarding how to file Form 1040 correctly for tax returns? Share your thoughts with us in the comments section below.

Continue Reading:

Leave A Comment