Are you a shopaholic who is more into using electronic money? Do you desire to use easy payment methods that provide credit? Well, you can consider reading this article then. Here, you can learn about Clearpay, a payment method that allows you to buy different things on credit.

The aforesaid payment service can provide you with the chance to shop without paying the total price for anything instantly. So, you might be thinking about credit cards that serve the same. The difference between credit cards and payment services is that the latter has no chargeable interest.

Here, you can learn the complete working process of Clearpay and read about five similar options. However, at first, take a look at the benefits of using a payment service. Have a look:

Contents

Benefits Of Using Payment Services

As you now know what is it, it is time to know about the general benefits of the payment services. Have a look below:

1. Get Conveniences On Every Payment

No matter which payment service you choose, there are a lot of conveniences you can get. In addition, there are a lot of Clearpay shops from which you can purchase items to enjoy these conveniences.

2. Optimum Security

Most payment services like Clearpay UK have proper online security setups. These ensure that the user does not ever face a monetary nuisance while using the service.

3. Provide Proper Transaction-Related Reports Daily

As a customer using the aforesaid payment service and shopping from the Clearpay store, you can get daily reports. These reports show the transactions clearly as you can keep track of the net amount you owe.

Now that you know about the advantages of using payment services like Clearpay, it is time to understand how it works. Here are the points:

Working Process Of Clearpay

Here are the known facts regarding the process by which Clearpay works. Have a look:

As An App

Simply put, Clearpay is an app that you can install on your smartphone. In addition, it can help you get access to Clearpay stores. As a result, you can purchase from those stores and choose Clearpay as the payment option.

Clearpay Shows Your Installment

Clearpay shows your installments clearly, and it can help you to pay simply. All you need to do is open a Clearpay account. In the case of every purchase, the credit would be divided into four payments. You can simply pay the entire amount every two weeks.

Clearpay Is Compatible With Debit/Credit Cards

Clearpay can cut installments directly from your card (debit/credit) whenever it is time. First, however, you need to turn on such settings. After that, you can even pay the dues on your own, checking the transaction list at any time. So, as per the overall picture, you can expect the account to be your money manager.

Points To Consider While Using Clearpay

There are some points that you should consider while using it. They are:

- Funds in your cash card

- The period for which you are actively using it (the limit increases with time)

- The number of active orders on Clearpay

- Net repayable amount

- The worth of the order that you place

- The late fees you have to give on failing to make a timely payment

So, all the above points here show “how does Clearpay work.” Now, you can consider starting using the it’s app. Nevertheless, there are some alternatives of Clearpay too. Consider taking a look at them.

Top 10 Alternatives Of Clearpay

This section of the article deals with the alternatives of the Clearpay app. You should know about them as it would be easier for you to switch in case of necessity.

Clearpay Alternative #1. Affirm

Affirm is a payment service platform that has similar services to Clearpay. Therefore, it is best for online retailers who desire to provide customers a chance to pay for a commodity over time. The salient features of Affirm are here:

Features:

- Affirm provides training in the form of documentation and webinars.

- Multiple platform compatibility.

- Affirm is valid for shopping cart, payment processing, eCommerce, and installment payment.

- Affirm comes with a lot of integrations.

Clearpay Alternative #2. Happy Returns

Happy Returns is another alternative to Clearpay, and the shops that use it accept this app. It allows every customer to save at least 10% of their yearly expenditure. Look for the features of Happy Returns below:

Features:

- Happy Returns provides handsome limits to the purchasers.

- The Happy Returns app is paid, and there is no free version.

- Happy Returns is the best when it comes to ordering in bulk.

Clearpay Alternative #3. Spiltit

The name Splitit clearly shows the service that the app does. It is similar to Clearpay in all accords. The top features of this app are given below:

Features:

- Splitit has an over 80% approval rate.

- Shoppers can break down their payments into 36 monthly installments ( interest-free).

- You would never face the risk of cart abandonment with Splitit.

- Like Clearpay, it works with all types of cash cards.

Clearpay Alternative #4. Sezzle

Sezzle is a public-benefit corporation that runs a “Buy Now-Pay Later” service. The primary audience hold of Sezzle thrives on US and Canada. It is an app that controls nearly 17,500 online merchants.

Features:

- Like Clearpay, Sezzle also gives interest-free credit.

- There is a Free Trial for Sezzle available.

- The ultimate security setup of Sezzle is its remarkable feature.

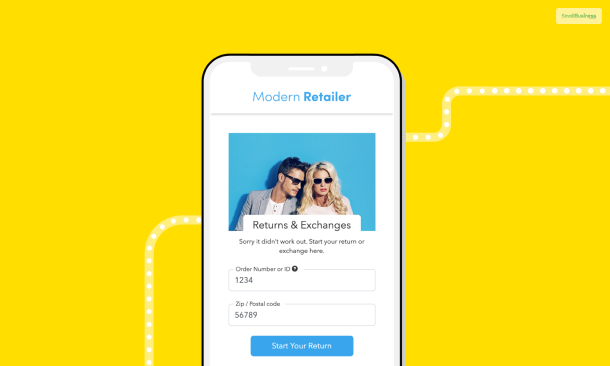

Clearpay Alternative #5. Humm

Humm is yet another payment service app and an alternative to Clearpay. It has similar services and some salient features. This app is best for the online merchants and e-commerce retailers.

Features:

- Humm, as an application, is quite flexible.

- Humm allows online integration with many e-commerce providers.

- In addition, unique integrations like Direct Rest API and pricing widgets are present on Humm.

Clearpay Alternative #6. Balance

It is the first self-serve checkout accepting 100% of the checkout complexities. Also, it is also a zero-interest payment service allowing customers to pay in installments.

Features:

- Multiple accounts receivable options.

- Customer service is available to the users 24/7.

- Multiple payment getaways include credit/debit support, ACH/eCheck support, and point-of-sale.

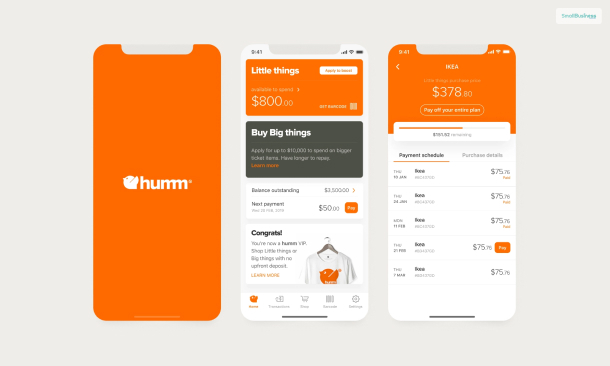

Clearpay Alternative #7. DeFerit

Another great alternative to the ClearPay payment service is Deferit. You can pay your bills in fortnightly installments thanks to the DeFerit payment processing service. There is no need to worry about paying a fine for late submission.

Features:

- Users can avail of discounts by paying on time.

- This budgeting tool keeps track of all of your bills and payments.

Clearpay Alternative #8. OpenPay

If you want to pay for your purchased items later and pay in interest-free instalments, then you can try OpenPay.

Features:

- The platform partners with different merchants across industries, such as automotive, beauty, lifestyle, fashion, healthcare, dental, home, sports, and more.

- You can select your installment periods between two months to 12 months.

Clearpay Alternative #9. Bread

If you were looking for buy now, pay later platforms like ClearPay, then Bread is probably one of the best alternatives.

- Users will get a wide range of services in consumer, retail, and eCommerce platforms.

- The payments through Bread are transparent and without any hidden charges.

- Also, you can schedule payments before due dates. The automatic payments make it hassle-free for you to pay.

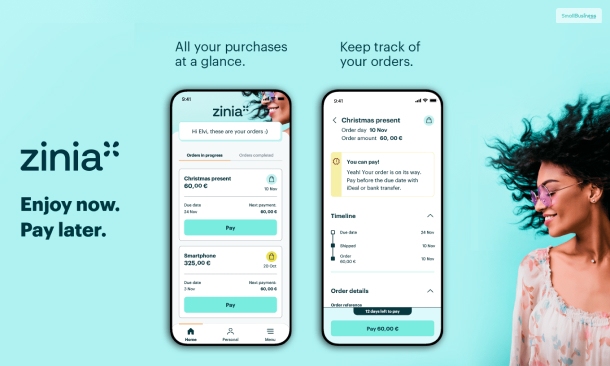

Clearpay Alternative #10. Zinia

Zinia is another ‘Buy Now, Pay Later platform. They have more than 2 million customers based in the US.

- You can split your transaction and spread it across months through installments.

- The platform offers services for both online and offline transactions.

Frequently Asked Questions!! (FAQs)

Here are some relevant questions related to ClearPay. I have answered them, feeling you might need them.

Yes, Clearpay is the same as Afterpay. The last name knows the same app in the UK. The contact Clearpay procedure is also the same in the UK but with a different name.

Clearpay does not do any credit checks. So, you can use it in case you have a negative credit rating. However, if you face financial instability, you should avoid shopping in bulk from the shops that use Clearpay.

Yes, the Latest app enables you to use it from anywhere. All you need to see is who accepts Clearpay while shopping. Some shops that are using it are:

1. Tu clothing

2. Clearpay

3. Wayfair UK

4. Mint Velvet

You can pay installments for six weeks after purchasing anything from Clearpay.

Final Take Away

People have had a main interest in the credit system from ancient times. However, the modern monetary system puts a restriction on it.

Clearpay and other payment service apps allow people to give payments in installments after a specific purchase. In the US, it is a subject that has a bright future. It is due to the less burden of usage than credit cards.

Also Read: